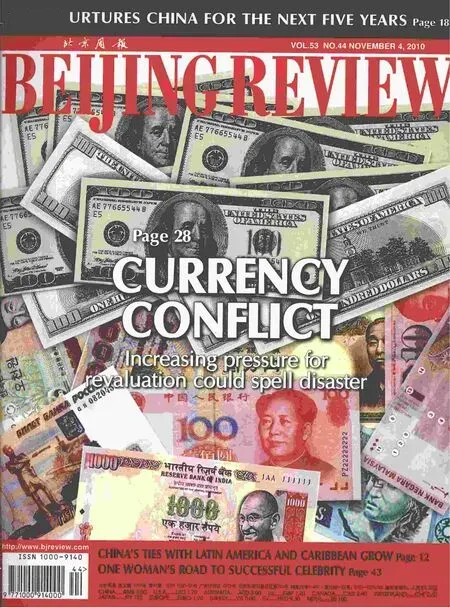

Preventing a Currency War

By YU SHUJUN

Preventing a Currency War

By YU SHUJUN

On the global econom ic recovery’s already unpredictable road, the latest threat comes from the possibility of a currency war.

A lthough worries about the war have recently been alleviated,as G20 financial officials vowed to “refrain from competitive devaluation of currencies” at their meeting in Gyeongju, South Korea, on October 21-23, more than just words and promises are necessary to avert a currency showdown.

The G20 summ it to be held in Seoul next week certainly provides an appropriate venue for participating leaders to take concrete and effective actions in this regard.

The latest depreciation race started after quantitative easing initiated by the United States and was followed by the EU and Japan. The goal was to spur their economies by devaluing their currencies to make their exports more competitive as the effects of fiscal stimulus measures began to fade. However, this has created heavy pressure on emerging economies to appreciate their currencies—and some countries, like Brazil, are now resorting to foreign exchange market interventions for fear of an export slump and surging capital inflow that could sabotage their economic stability.

Some developed countries, especially the United States, have been accusing China of undervaluing its currency, the yuan. The fact is, however, that China has accelerated the reform of its exchange rate regime and increased the flexibility of the yuan since June this year. The yuan has appreciated more than 2 percent against the U.S. dollar. Obviously, China should not be to blame for the issue.

In a world of increasing interdependence, developed countries’ measures to salvage their own economies should not be at the expense of other countries’ interests. Otherw ise, their measures are no different from protectionism and w ill do no good for the global economy as a whole.

So far, the situation hasn’t escalated to a real currency war.But if such a war is triggered, the damage to the world economy w ill be devastating. A trade war w ill almost certainly ensue and international investment w ill be stifled, which w ill, in turn, slow down the pace of the global econom ic recovery and could even lead to a true economic depression.

The still-fragile global econom ic recovery needs the concerted efforts of all countries. An airport talk between Chinese Vice Premier Wang Qishan and U.S. Treasury Secretary Timothy Geithner in the Chinese city of Qingdao last week has sent positive signals for more coordination. It should be pointed out that developed countries should shoulder more responsibilities.

It is expected that the G20 Seoul summit w ill reach consensus on currency policies and bring about a better solution to end the depreciation fiasco.