Forecasting of the Egg Price Based on EEMD

Dan WANG,Yucheng HE

College of Economics and Management,Huazhong Agricultural University,Wuhan 430070,China

1 Introduction

In order to achieve the transformation of economic development mode,the state has adopted a series ofmeasures to better achieve a smooth transition of the economy.According to the deployment of Central Document No.1,Xinjiang,Inner Mongolia and Northeast China have started the implementation of the target price system for cotton and soybean.Themain task of the reform is to loosen up prices of some competitive goods and services,improve and expand the living tiered price system.Following the pilot areas,the location and scope of reform will be further expanded.Shandong Province also actively explores the establishment of agricultural product target price system,and the scope of agricultural productswill be expanded to vegetables,pigs and other products.Egg is an important source of protein intake for the residents,and it is an integral part of the residents'food consumption.In recent years,there have been frequent fluctuations in the price of eggs,affecting the smooth running of the eggmarket.The fluctuations in egg price affect egg consumption,and change consumption structure,thereby affecting the welfare and well-being of residents.Therefore,the further analysis of the egg price fluctuation characteristics and its future direction of change can help to understand the variation of the price of eggs,in order to provide a reference for determining the target price of eggs and maintaining egg price stability.

2 Egg price fluctuations

Overall,China's egg price shows a fluctuating upward trend.The annual average price increased from 6.22 yuan/kg in 2006 to 9.9 yuan/kg in 2013,with average annual growth rate of 6.85%.As can be seen from Fig.1,the egg price changes can be roughly divided into three phases.(i)January 2005 to August 2006.The egg price was stabilized at 6 yuan/kg.(ii)September 2006 to August 2010.The egg price steadily fluctuated around 8 yuan/kg.(iii)September2010 to July 2014.The egg price sharply fluctuated around 10 yuan/kg,and even dropped back to8.23 yuan/kg.As can be seen from Fig.2,the volatility of egg price index is greater than that of food consumer price index,indicating that there are instability factors affecting the price fluctuations.Now we take the second phase for analysis.The second phase lasted 48 months from September 2006 to August 2010.The period from September 2006 to August2007 is the initial period from the first phase to the second phase.Due to the low price base in the first phase,the egg price index is higher than food consumer price index.In the period after September 2007,the price rise slowed down and the egg price index was smaller than food consumer price index,but the trend is gradually narrowing,and eventually consistent.The change in the third phase is similar to that in the second phase,but the egg price index was higher than food consumer price index in the third phase.This phenomenon wasmainly due to the significant decline in egg price in 2012.

3 Em pirical analysis of egg price

China's egg price shows a fluctuating upward trend,and it is nonstationary time series.Existing studies have shown that the hybrid forecasting can reduce error and improve prediction accuracy.In the forecasting of agricultural product price,the method most widely used is the hybrid forecastingmethod based on wavelet decomposition.Wavelet decomposition is to pull the time series and decompose it into trend term,intercept term,circulation term and random term,and perform the forecasting based on different decomposition items.However,the wavelet decomposition is dependent on the selected primary function,and different primary functions will form different decomposition results,thus resulting in different information content.This global analysismodel causes poor robustness of themodel.The primary function in EEMD decomposition method changes with its own information change,which overcomes the shortcomings of primary function selection during the practical application of wavelet decomposition.EEMD has the advantage of adaptability and robustness,so this paper proposes the three-step predictionmethod based on EEMD decomposition.First,we use EEMD to divide the egg price into several series,and then use ARMA and BP to forecast the decomposed time series,and finally combine the predicted series to calculate the predicted values of the egg price.Specificmethods are as follows:

This paper collects the data from January 2005 to August2014.In order to test themodel's prediction accuracy,we take the data from January 2005 to December 2013 as the original data to be fitted during the establishment ofmodel,and then perform forecasting based on the data from January to August 2014,and assess the forecasting effect ofmodel according to the difference between the actual values and predicted values.And the egg price data are from China Livestock Information Network.

3.1 EEMD decomposition of the egg priceEEMD(Ensemble EmpiricalMode Decomposition)isamethod foranalyzing nonstationary time series.The calculation process of EEMD decompositionmethod is as follows:(i)adding the Gaussian white noise signal to the original time series to form new time series;(ii)finding themaximum value of the new time series and using cubic spline interpolation function to fit themaximum value to form the upper envelope;fitting the lower envelope of theminimum value in the same way and calculating the average envelope;removing the average envelope from the new time series to get the series free of low frequency;(iii)repeating the process(ii)for the series free of low frequency until themean of average envelope approaches zero to get the first IMFby decomposition;(iv)removing the first IMF from the new time series to get the difference series;repeating process(ii)and(iii)for the difference series and calculating new IMFn component until it can not be decomposed to get residue series Rn;(v)circulating the above process;calculating the population mean of IMFn components to eliminate the influence ofGaussianwhite noise in process(i)on series toget the real IMFn;calculating the population mean of the residue amount Rin to get real Rn.Thematlab programming is used to achieve the above process,and the results of decomposition are shown as follows:

3.2 Fitting and forecasting of IMF and Rn com ponentsEEMD is decomposed into five IMF components and one remaining component Rn.IMF component keeps the fluctuation characteristics of the original signal and effectively isolates the non-stationary nature of different components,to greatly improve the stationarity of the original time series.From IMF1 to IMF5,the fluctuation frequency decreases.IMF1 and IMF2 are the high frequency parts of the original series,and the fluctuation is complex,so it is necessary to use ARMA model for fitting.The parts from IMF3 to IMF5 are the low-frequency partsof the original series,the fluctuations and cycle exhibit certain regularities,and the data can well construct the shape of fluctuations,so it is necessary to use BP neural network for fitting.The remaining component Rn shows a rising trend,and the BP neural network is also used to fit.

3.2.1Fitting and forecasting of IMF1 and IMF2 components.ARMA is also known as auto-regressivemoving averagemodel.A stationary stochastic time series can be explained by its pastvalues and random disturbance term.It is generated by the ARMA(p,q)process,where p is autoregressive order and q is the moving average of order.Prior to the establishment of ARMA model,we first perform the random stationary test on IMF1 and IMF2.

Table 1 ADF and LB test results

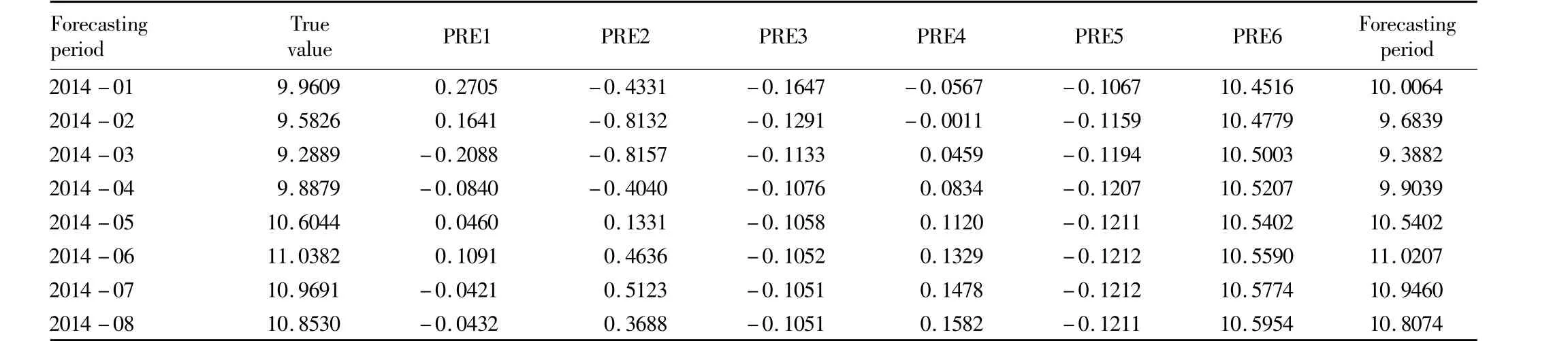

According to the ADF test results,IMF1 and IMF2 reject the null hypothesisat1%significance level,and there isno unit root.IMF1 and IMF2 are stationary time series.According to test results of LB,IMF1 and IMF2 reject the null hypothesis at1%significance level,the series data havememory,and we can use the past values to predict the future values.Then according to SICand SC values,we determine the order selection of p and q in ARMA model.Autocorrelation and partial autocorrelation show tailing,and autocorrelation plot shows a rotary type,indicating that there are negative roots.We set the upper limit of p and q at 5,and then model the different combinations of p and q.According to AIC and SCminimal optimization principles,IMF1 model is ARMA(5,4)and IMF2model is ARMA(4,4).We establish the model to get predicted values of IMF1 and IMF2,as shown in PRE1 and PRE2 in Table 2.

3.2.2Fitting and forecasting of IMF3,IMF4,IMF5 and Rn components.BP,an abbreviation for"backward propagation oferrors",is a common method of training artificial neural networks used in conjunction with an optimization method such as gradient descent.Themethod calculates the gradientof a loss function with respects to all the weights in the network.The gradient is fed to the optimization method which in turn uses it to update the weights,in an attempt tominimize the loss function.BP requires a known,desired output for each input value in order to calculate the loss function gradient.It is therefore usually considered to be a supervised learningmethod,although it is also used in some unsupervised networks such as autoencoders.It is a generalization of the delta rule tomulti-layered feedforward networks,made possible by using the chain rule to iteratively compute gradients for each layer.The basic process is as follows:(i)setting the artificial neuralnetwork as two-layeredmodel,the number ofneuron in hidden layer as20,and the learning error as0.001;(ii)randomly giving theweights of each layer;(iii)Using tangent function in the first layer and linear function in the second layer;obtaining the output data of each layer by the given input data;calculating the learning error of each layer;(iv)using the Levenberg-Marquardt algorithm to correct the weights of each layer according to the error,and repeating the above process until the learning error is less than 0.001.Matlab programming is used to achieve the above process,and the forecasting data are obtained as shown in Table 2.

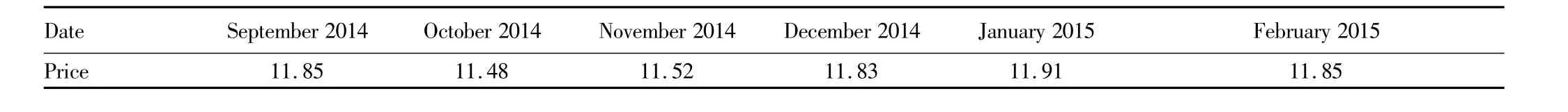

3.3 Combination forecasting and analysisAt the EEMD decomposition stage,we add the Gaussian white noise to the original data,so that the sum of IMF components and Rn is not equal to the original data,and there is error between 0.1 and 0.01.The order of magnitude of IMF decomposition amount is generally small,and the values with order ofmagnitude less than 0.1 account for 42%.It is highest for IMF5,with the proportion reaching 62%.These errors affect the validity of time series forecasting,so there is a need to establish amodel to combine the forecast data,eliminate the effects of Gaussian white noise on series,and improve the prediction accuracy of the model.Using ANN neural network,we establish the combination model and perform fitting with components decomposed by EEMD as the input varia-bles and real prices of egg as the output variables and then forecasting seriesas the inputvariables,to calculate the predicted value of egg price.In order to evaluate the accuracy of forecasting,this paper uses MSE(Mean Absolute Error),MAE(Mean Absolute Error)and MAPE(Mean Percentage Error)to evaluate.After the above forecast results are put into the indicators,we calculate MAE at5.16%,MSE at0.37%and MAPE at6%,indicating that the forecasting effect of thismodel is very good.Using the three-stepmodel based on EEMD decomposition,we forecast the egg price,and the results are shown in Table 3.The egg price fell from 11.85 yuan/kg in September 2014 to 11.52 yuan/kg in November 2014,but then it began to rise.In January 2015,the egg price reached 11.91 yuan/kg and dropped to 11.85 yuan/kg in February.

Table 2 Combination forecasting of the egg price

Table 3 The egg price from September 2014 to February 2015 Unit:Yuan/kg

4 Conclusions and discussions

4.1 ConclusionsIn the transitional period of"new normal",the target price is put forward to deepen the reform system of agricultural product price.Egg is themain agricultural productand its price has fluctuated violently in recent years.Setting up a target price for egg will reduce the price fluctuations.This article brings up a three-step agricultural price forecastingmodel based on EEMD and applies it to the analysis of egg price.It shows that the upward trend can be divided into three stages,and the fluctuation is greater than that of food consumer price in the foreseeable future.The volatility of egg price is bad for the development of the freshmarket and stable life of the residents.

4.2 DiscussionsFirstly,the sharp rise in egg priceswill lower the quality of life of residents.Eggsare living necessities,and the price elasticity is small.According to Engel's Law,the declining share of non-food expenditure in total household expenditure indicates that the living standards of residentswill decline.Secondly,fluctuations in the price of eggs will affect the residents'expectation of future expenditures.Egg price volatility increases the risk,and residentsmay reserve a certain amountof currency for this risk out of prudentmotive,and the currency reserves increasewith the price volatility.One of the aims of the nationalmacro-control is to maintain price stability,and the government should develop some strategies to ensure the stability of the price of eggs.When carrying outmacro-control,it is necessary to be based on the future predicted prices.The price forecasting model in this paper has high prediction accuracy and applicability,and it can be used for the price forecasting of other products,thereby providing a better way for price-makers to forecast price.In the evaluation of price controlmeasures,the policy researchers can use thismodel as a reference.Themodel proposed in this paper can not only be applied to the price forecasting of a single item,but also be applied to price forecasting of related items.BP neural network can simulate the complex numerical relationship in real life,so it can be used to study the price interaction between different products.

[1]DINGWN,HE YC,LIUCC.The fluctuation trend ofmaize price in China and its short-term prediction[J].Price:Theory&Practice,2014(4):83-84.(in Chinese).

[2]XUMF,LIU HG.The forecast and analysis of egg price in China[J].Statistics and Decision,2014(6):104-107.(in Chinese).

[3]CHENG GQ,HU BC,XU XG.Analysis on the influence of price rising of new round agricultural products[J].ManagementWorld,2008(1):57-62.(in Chinese).

[4]LIZG.Analysis on system economics of pork price[J].Price:Theory&Practice,2009(3):21-22.(in Chinese).

[5]LU XT,SUN Y,DU LL,etal.Prediction of seawater temperature time series based on EMD[J].Ocean Technology,2009,28(3):79-82.(in Chinese).

[6]ZHENG JD,CHENG JS,YANG Y.Modified EEMD algorithm and its applications[J].Journal of Vibration and Shock,2013,32(21):21-26.(in Chinese).

Asian Agricultural Research2015年7期

Asian Agricultural Research2015年7期

- Asian Agricultural Research的其它文章

- On Modern Fruit Production in Japan

- Study on the Improvement of Performance of Global Supply Chain Based on Quantity Flexibility Revenue Sharing Contract

- Supply Chain Optimized Strategies in the Mode of External Financing

- Financial Support for Rural Cooperative Economy in China Based on Grey Correlation Analysis

- A Study on the Driving Factors of Food Production in Huang-Huai-Hai Plain Based on Path Analysis

- An Analysis of the Consumer Demand Structure of Rural Residents in Chongqing City in the Context of New Urbanization