Factors Influencing University Students Digital Banking Choice Behaviour

WANG Sulin, JING Mengyuan

(1.Business School,University of Leeds,Leeds LS3 1FF,United Kingdom;2.International Education Institute,Henan University of Economics and Law,Zhengzhou 450000,China)

Abstract:Digital Banks are a large growth sector within the banking industry,providing cutting edge technological based banking services globally. Nevertheless,to challenge traditional banks,customer perceptions must be investigated for digital banking companies to improve their products and compete more effectively.To gather insight into the digital banking sector,both qualitative and quantitative research has been carried out through paired interviews for high detail,opinion-based data,and secondarily an online survey for a larger data set.Findings from the research suggest that while digital banking is a growth sector in the UK,there is still a lack of knowledge and confidence towards these banks from a student perspective.Students’satisfaction with traditional banks is still higher than the satisfaction with digital banks. The research also highlighted the factors students evaluate traditional and digital banking differently based on criteria such as reputation,features and physical branches,suggesting digital banks should focus on those criteria to become more competitive.

Key words:digital banks;traditional banks;UK university students;students banking choice behaviour

In banking industry,owing to the financial crisis in 2008,the UK government has delivered banking licenses to over ten new banks in recent years[1]. Over the past few years,digital banks such as Revolut and Monzo have took away millions of clients from traditional banks[2]. There is an increasing trend for digital banking penetration in the UK from 2007(30%)to 2019(73%).Additionally,digital banking innovations merged online banking solution in the last decade(Office for National Statistics(UK),2019)[3]. Relating to the traditional banks,one of the industry features that strengthens the significance of competition is the comparatively low switching costs to digital banks,particularly in the retail banking market[4].

According to Blacker(2019),from April 2018 to September 2019,downloads of digital banking Apps have grown 209% and the top markets for this industry is United Kingdom and United States[5]. Monzo is the leader digital bank App in the UK by the share of monthly active users,followed by Revolut,Starling Banks and N26. Recently Monzo achieved more than 50% of market share. However,according to Deloitte(2019),there is an increasing investment on the digital banking services among traditional banks as well[6]. The huge competitive advantages for traditional banks in terms of resources and brand reputation could be threats to digital banks[7].

Types of banking account offers by digital banks are limited comparing with traditional banks[8]. Traditional banks provide customers with a range of other services,such as credit cards,financial investments,mortgages and insurance. Additionally,traditional banks offer their services through significant physical outlets in almost every city in the UK while digital banks are lacking[9]. However,the number of customers visiting physical banking stores is estimated to fall by 36%,while the number of mobile transactions will go up to 121%from 2017 to 2022[10].

Meanwhile,with the development of digital bank industry,some issues of using digital banks are widely concerned,for example,private information and basic safe. According to YouGov,the General Data Protection Regulation(GDPR)required banks to protect the privacy of their customers data.Which shows the transparency of how customers data has been collected,processed and shared by the bank is becoming the main concern among regulators and customers[11].

In order to expand its market and target widely customers,digital banks are expecting to target new generation consumers.According to Mintel(2017),millennials are the main age group who are more likely to firstly adopt the digital financial management services with strong desire of using more convenience financial service[7]. It indicates that digital banks should satisfy millennials’demand for aggregation,simplification and personalized recommendations to expand their market share.

Digital banks operate solely through digital means such as through mobile banking apps and online banking,shedding the need for traditional local branches,in favour of innovative services and modern brand images.Though if the digital banks are to survive/thrive,greater market share must be acquired,and to do this,digital banks must understand both customer’s and no customer’s perceptions to develop a strong brand perception.In this paper,a focus on students studying in the UK was chosen as the sample demographic,due to their availability to participate in the research and their consumption habits towards digital products. To gather enough insight into the current perceptions of digital banks among university students,paired interviews and a survey were used to gather both qualitative and quantitative data to support the research. Recommendations section will conclude the paper in which suggestions will be made to aid digital banks in how to operate more effectively versus traditional banks.

1 Research Design and Methodology

1.1 Qualitative Research

1.1.1 Qualitative Research Methodology

To gather enough insight into the opinions and beliefs of students towards both traditional and digital banks,qualitative research was used in the form of paired interviews.Participants were chosen based on geographic(2 UK,2 EU,4 Non-EU),one participant of each nationality uses digital banks while the other participant does not. This method was used so that the paired interviews would be a discussion between users and non-users of digital banks to allow ideas to bounce of each of the participants. This also created an atmosphere of debate allowing for ideas to flow between the participants,requiring less prompting and probing from the moderator,in some ways creating data with higher validity and less influence/bias from the moderator.

1.1.2 Research Framework/Variables

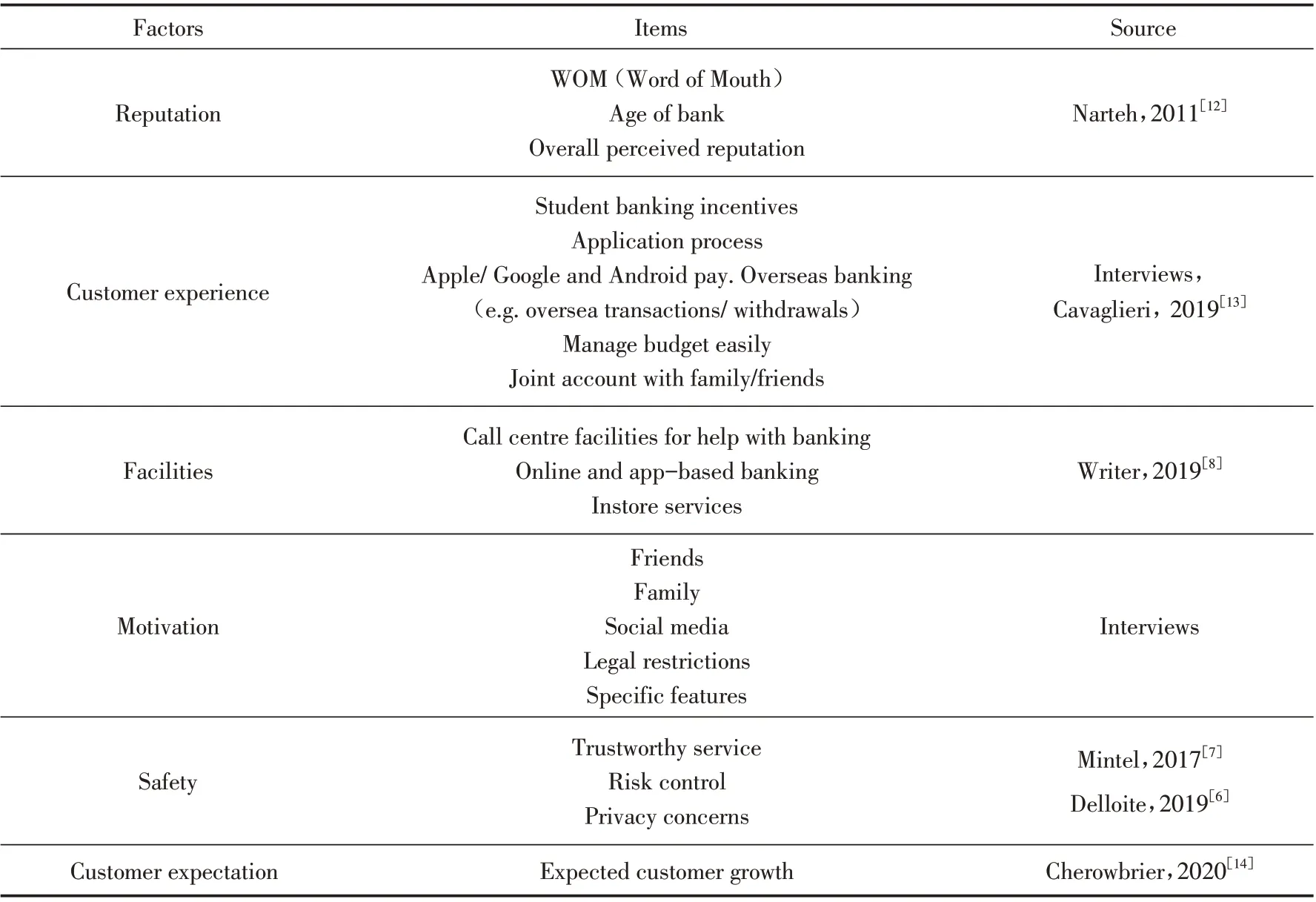

Based on the qualitative findings,following factors(Tab.1)are extracted.

Tab.1 Research Variables

1.2 Quantitative Research

1)Research Method

The main approach of quantitative research is survey.Through the dissemination of the online questionnaire,a large amount of data can be obtained in a fast pace,which will be beneficial for further data analysis.

2)Sampling Design

The survey collected 155 samples(Tab.2)and adopted a non-random sampling method,including convenience sampling,judgement sampling,quota sampling and cluster sampling. The survey is delivered to university students who are the potential markets of digital banks and allows researcher to save cost and time.

3)Questionnaire Design

The questionnaire covers several areas in terms of students’banking choice behaviour towards traditional and digital banks. The first sectioncovers which traditional banks and digital banks the respondents are currently using and different communication channels which might influence their choices.The second section displays a list of banking choice criteria which are concluded from the secondary research and qualitative research.The third section refers to bank evaluation in terms of both traditional and digital banks.And the fourth section is personal information.We choose three types of question formats including multiple choice questions,rating scales questions and matrix questions. There are 7 scales in the rating scales questions and matrix questions while 1 equal to strongly disagree and 7 equals to strongly agree.

Tab.2 Respondent Distribution

4)Analytical Issues

In order to get a deeper and more detailed information about the study,it will demonstrate some figures through graphical representations,basic statistics,regression analysis,ANOVA test and finally regression analysis. Firstly,it is going to conduct some graphical demonstrations in order to have a clearer understanding about the respondents as the current status of students banking choice and their awareness through digital banks.Secondly,it will conduct basic statistics as mean and standard deviation to understand the overall satisfaction between traditional and digital banks.Also,it is going to take an ANOVA Test to examine whether there is a significant relationship between UK,EU,Non-EU students and the influential communication elements on choosing a bank and if there is any relationship between the country origin and the overall factors for choosing a bank(Reputation,Facilities,Consumer Experience and Privacy Concern). Finally,it will conduct two multiple regression analysis using the Enter Method used to test whether the four predictors exert a positive significant influence on the criterion variable(traditional banks and digital banks).

2 Results and Analysis

2.1 Qualitative Research Findings

Through the four groups interviews,it came that there are similarity and difference perceptions among students from UK,EU and Non-EU students.The results are showed below.

1)Different communication channels influence on awareness of digital banks

The British students had awareness of digital banks through“Instagram advertising”and Word-Of-Mouth from friends and family. The Thai students started to use digital banks due to a senior’s advice. Meanwhile,the Chinese students were attracted by the“convenient functions”on the mobile application of digital banks.

2)Digital banks are more user-friendly than traditional banks

All of the participants agreed that digital banks are more convenient than traditional banks because digital bank accounts have easy and fast application process.The Thai students mentioned that to create an account in the traditional bank,the bank letter was requested and amounts of questions were asked while applying for digital banks only need a few steps.

3)Digital banks help students save cost

There is low service fee relate to currency exchange for digital banks and the currency exchange rate is generally lower than traditional banks which will be beneficial for EU students’daily expense and UK and Non-EU students’travelling to EU.In addition,“memberships of a digital bank are more affordable than the services provided by traditional banks”,which means digital banks are more suitable for low-income group among students.

4)Response to personal queries

Most of students complained that waiting time for in store services in traditional banks is too long,but they still regarded lack of physical stores as a limitation of digital banks. EU students believe that“In digital banking it is more difficult to find answers to any questions we have”.Besides,when card problems occurred,Chinese interviewees prefer to go to the physical banks for help due to the language issues and the quick response of face-to-face communication.

5)Students’concerns:safety issues

Safety issues are students’main concerns about digital banking. Compared with traditional banks with a long history,digital banking is an emerging industry. This makes students take a sceptical attitude on its credibility and reliability.EU students mainly concerned about privacy.For example,digital banks have lack of security because it is“easier for others to access to our data”,lack of legal protection.Moreover,the fact that internet is not 100%safe and customers only can have access to the app with internet connection.“Digital banks,despite their associated risks,tend to grow and are undoubtedly a beneficial innovation for people’s daily lives”. UK student users of digital banks suggested they keep less than two hundred pounds in their digital banks,while keep the resting in a more secure traditional bank such as one of the Big five(HSBC,Barclays,Lloyds,RBS,NatWest).

6)Promotion for students need to be improved

Based on the Chinese student’s experience,promotion in the university has raised the number of student’s users in traditional banks.Digital banks could“do promotional activities during freshman welcome week”in order to increase the awareness among foreign students.Moreover,EU students believe digital banks should give more rewards and special offers to students.

2.2 Quantitative Research Result Analysis

2.2.1 Students General Banking Choices Towards Traditional Banks and Digital Banks.

Through the overall banking choices,over two-thirds of the respondents use both traditional bank and digital bank,but 31.6% of them only use traditional bank. Meanwhile,86.5% of respondents stated that they had heard of digital banks before while 13.5%of them had not.

Meanwhile,almost 60 respondents are using Lloyds banks,while the second group is HSBC and Barclays’users,between 30 to 40. While,more than two thirds respondents had heard of Monzo bank. Subsequently,the number of students who had heard of Revolut and Starling bank is similar,which are both around 30 people.However,more than 20 people indicates that they had never heard of any digital bank.

2.2.2 Students Perception about Traditional and Digital Banks

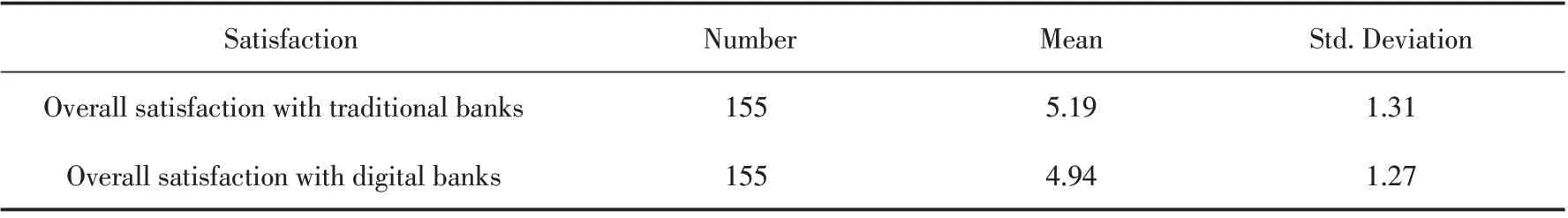

With means and standard deviations of this table we can assume that overall student satisfaction with the traditional banks(mean=5.19)is higher than the digital banks(mean=4.94). The standard deviation is higher in traditional banks. Therefore,there is higher variability of the responses among the sample. Relating to the overall satisfaction with digital banks,the standard deviation is lower,so the answers for this question were more similar(Tab.3).

Tab.3 Satisfaction with traditional banks and digital banks

2.2.3 Communications Channels Influencing Students Banking Choices

In this section,the mean is used to identify which channel influence students’banking choices the most.The table below shows recommendations from family members(mean=5.10),friends(mean=5.39)and social media(4.20)are the most powerful ways to affect students’banking choices. However,the figures of advertisements(mean=3.88),newspapers(mean=3.45)and magazines(mean=3.34)are lower than 4,which indicates these three channels have no impact on students’banking choices.

2.2.4 Geographical Factors Influencing Digital and Traditional Banking Choices

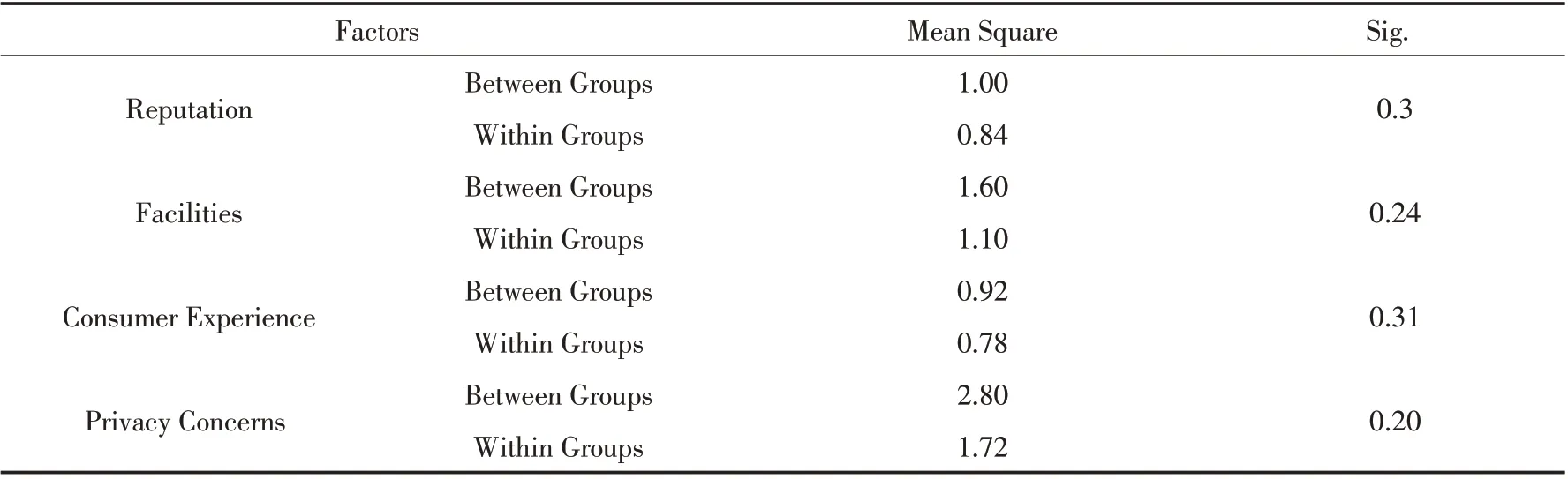

In order to understand if there are different considerations among three different geographical groups in terms of choosing banks,an ANOVA Test has been carried out.Based on the results,there are not significant in relation to any of four factors criteria towards different geographical groups choosing a bank,as all four significances are atp>0.05 level. Which indicates that these three geographical groups evaluate these four factors as a similar level when they are choosing banks(Tab.4).

Tab.4 Geographical Factors

2.3 Hypotheses Testing

In this section in order to carry out further analysis,the research model as Fig.1 is developed,and several hypotheses tested.

To further analyse the results from the survey by examining relationships between key variables(Fig.1),the following hypotheses are tested below:

H1a:Reputation exerts a positive significant influence on Traditional Bank Evaluation.

H1b:Facilities exerts a positive significant influence on Traditional Bank Evaluation.

H1c:Consumer Experience exerts a positive significant influence on Traditional Bank Evaluation.

H1d:Privacy Concern exerts a positive significant influence on Traditional Bank Evaluation.

To test the above hypotheses,a multiple regression analysis using the Enter Method was used to test whether the four predictors(Reputation,Facilities,Consumer Experience and Privacy Concern)exert a positive significant influence on the criterion variable(Traditional Bank Evaluation). Note the AdjustedRSquare value 0.223,which shows a low correlation between the four predictors and the criterion.A significant model emerged(F4,150=12.038,p=0.000).Significant results emerged from the results are shown as Tab.5.

Fig.1 Research Framework

Tab.5 Students’Evaluation of Traditional Banks

The results indicate that both Reputation and Facilities are strong predictors of Traditional Bank Evaluation,hence supporting the hypotheses H1a and H1b. Facilities is the strongest predictor of Traditional Bank Evaluation which shows the largest Beta coefficient(0.303). This shows that 30.3% of the variation in the Criterion variable(Traditional Bank Evaluation)is explained by Facilities. Reputation with a significant level of 0.013(p=0.013)with a Beta value of 0.203 explains only 20.3% of the variation of the Criterion variable. Therefore,Reputation of the Traditional Bank is making a lesser influence on the Evaluation of the Traditional Bank. Most noteworthy is the fact that Consumer Experience(H1c)do not seem to have a significant influence on the predictor variable with a Beta value of 0.065 and a p value of 0.533(p>0.05).Meanwhile,Privacy Concern(H1d)do not seem to have a significant influence on the predictor variable as well with a Beta value of 0.026 and apvalue of 0.761(p>0.05).Therefore,we conclude that H1a and H1b are both supported by the results but H1c and H1d is not supported by the results.

H2a:Reputation exerts a positive significant influence on Digital Bank Evaluation.

H2b:Facilities exerts a positive significant influence on Digital Bank Evaluation.

H2c:Consumer Experience exerts a positive significant influence on Digital Bank Evaluation.

H2d:Privacy Concern exerts a positive significant influence on Digital Bank Evaluation.

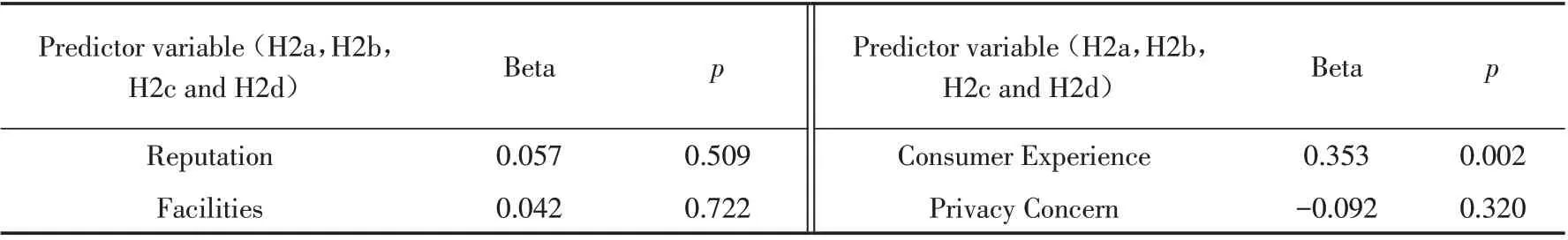

In order to test the above hypotheses,a multiple regression analysis using the Enter Method was used to test whether the four predictors(Reputation,Facilities,Consumer Experience and Privacy Concern)exert a positive significant influence on the criterion variable(Digital Bank Evaluation). Note the AdjustedRSquare value 0.121,which shows a very low correlation between the four predictors and the criterion.A significant model emerged(F4,150=6.286,p=0.000).

Significant results emerged from the results are shown as Tab.6.

Tab.6 Students’Evaluation of Digital Banks

The results indicate that only Consumer Experience is a strong predictor of Digital Bank Evaluation with a strong significant level of 0.002(p=0.002),hence supporting the hypotheses H2c.Additionally,Consumer Experience with the largest Beta coefficient(0.353)shows that 35.3%of the variation in the Criterion variable(Digital Bank Evaluation)is explained by Consumer Experience.Therefore,Consumer Experience of the Digital Bank is making the most influence on the Evaluation of Digital Bank.Most noteworthy is the fact that Reputation(H2a)do not seem to have a significant influence on the predictor variable with a Beta value of 0.057 andpvalue of 0.509(p>0.05).And Facilities(H2b)do not seem to have a significant influence on the predictor variable with a Beta value of 0.042 andpvalue of 0.722(p>0.05).Meanwhile,Privacy Concern(H2d)do not seem to have a significant influence on the predictor variable with a Beta value of-0.092 andpvalue of 0.320(p>0.05). Therefore,we conclude that H2c is supported by the results but H2a,H2b and H2c are not supported by the results.

3 Conclusion and Implications

3.1 Conclusion

This study set out to investigate and analyse the factors influencing students’bank choice behaviour between digital banks and traditional banks in the UK. The finding pointed out that although the digital bank industry is expanding,there are still a small percentage of students who have never heard of digital banks. Additionally,students’satisfaction with traditional banks is still higher than the satisfaction with digital banks. It indicated that there are still improvements for digital banks to consider comparing with their major competitor traditional banks.By evaluating different factors which might influence students’banking choices,the following conclusions can be drawn from the present study.

3.1.1 Influence of Communications Channels on Students’Banking Choice Behaviour

This study showed that friends’recommendation and families’recommendation could influence students’banking choices the most. While social media promotions(e.g. Instagram,YouTube,Facebook)is ranked as the third which indicates the importance of social media advertising for digital banks.This finding supported the previous literature review that students’banking choice decision is influenced by the sociological factors.Meanwhile,it confirmed the findings of the qualitative research that word-of-mouth from families,friends and social medias could have heavy impacts on students’banking choice behaviour.

3.1.2 Factors Impact on Students’Bank Evaluations

The second major finding from this study was that here are significant differences between traditional bank evaluation and digital bank evaluation in terms of what factors influence the most. For traditional banks,reputation(WOM,Age of bank,overall perceived reputation)and facilities(call centre facilities for help with banking,online and app-based banking,instore services)exerts a positive significant influence on evaluation. However,for digital banks,only consumer experience(student banking incentives,application process,Apple/Google and Android pay,overseas banking,manage budget easily,joint account with family/friends)exerts a positive significant influence on evaluation.This finding supported both literature review and qualitative research that for financial departments,creating customer perceived value is an essential way for banks to attract new customers and increase consumer loyalty[15].The convenient and user-friendly banking technology could assist digital banks to rise their perceived customer value among consumers.

3.1.3 Students’Concerns Towards Digital Banks

The finding carried out from the qualitative research showed the main concern towards digital banks is the credibility of the banks. Since digital banks is a new market,the reputation of digital banks tends to be lower than that of traditional banks.Additionally,the transparency of consumers’data has become one concern towards banks[11].However,the finding of quantitative research has shown that privacy concern made no significant difference to neither traditional bank evaluation nor digital bank evaluation.

3.2 Implications

According to Porter(1979),banking as a service has become increasingly a commodity,therefore banks must become ever more adaptive and agile to external forces to remain competitive[16].All these imply a potentially increasing market for digital banks in the long run.Applying these results to further market expanding,digital bank industry is advised to consider the following points in the future.Firstly,digital banks should use more buzz marketing to encourage consumers to talk about its user-friendly features to their peers and spread the positive WOM for digital banks. As customers tend to follow the crowed when making decision on choosing products and services[17]. Buzz marketing could be done through both offline promotions and online promotions by social media platforms. Secondly,in order to increase consumer satisfaction and consumer loyalty,digital banks should majorly focus on adding values to consumer experience. Abdul Hadi(2018)suggests that the only way for banks to regain loyalty and competitive is through the improvement of their banking services[18]. For instance,digital banks could create more interactive and creative functions on their apps to increase Perceived Enjoyment(PE)for consumers[19].Thirdly,as students is one major target consumer group of digital banks. It is important for digital banks to use more specific tactics such as face-to-face promotion on fresher fairs and student banking incentives to increase brand awareness among students.Lastly,the largest forces of which are technology and the rise of big data,which successful banks are utilizing to reinvent their relationships with their customers[20].Although this study showed privacy concern made no significant difference to students’bank evaluation,digital banks still have to carefully use consumer’s data and strictly follow the General Data Protection Regulation(GDPR).

3.3 Limitations

There are two major limitations in this study that could be addressed in future research.The main limitation is the sample bias as the geographic scope of participants are major Non-EU students. In this case,the people who responded to this survey may not truly be a random sample which can influence the accuracy of quantitative research findings. Meanwhile,the insufficient sample size of this research is another limitation that it is difficult to identify significant relationship from the data.