The "lose-lose" Brexit deal causes sharp decline in British textiles trade

By Zhao Xinhua

As the sixth largest manufacturing industry in the UK, the textile industry is positioned as a cultural and creative industry. The transformation of the British textile and garment industry from manufacturing to creative ideas is supported by innovative technology and theoretical research, and also by the cultivation of innovative design talents. To a certain extent, this shows that the UK plans to rely on creativity to reverse the decline of its economic growth, and also reflects the exploration direction of UK industrial transformation in recent years.

Textile in Britain suffered heavy losses

The trade data (January—September 2021) show a dramatic drop of imports and exports of textile goods between the EU and UK, with significant losses for companies on both sides. The situation is likely to get worse, as the full customs regime between UK and EU has entered into force on 1 January 2022. EURATEX calls on the European Union and the United Kingdom to ef—fectively cooperate to remove the issues in the EU—UK Trade agreement that prevent smooth trade flows.

In the past year, all industries suffered heavy losses due to pandemic factors, and the textile industry is no exception. Compared with the same period in 2020, from January to September in 2021, the EU imports (—44%, nearly 2 billion euros) and exports (—22%, 1.6 billion euros) both fell sharply. The UK Fashion and Textile Association (UKFT) surveyed 138 enterprises, including leading fashion brands, British textile manufacturers, wholesalers, fashion agencies, clothing manufacturers and retailers in the British textile industry.

According to the survey, 71% enterprises rely on EU imports. 92% of companies are experiencing increased freight costs; 83% of enterprises are experiencing the ris—ing cost of customs clearance and bureaucratic influence; due to the implementation of the EU—UK agreement, 53% are experiencing cancelled orders; 41% companies have been hit by double tariffs. The vast majority of companies surveyed said that they hope to pass the increased costs on to consumers in the next 6—12 months.

Due to the full implementation of customs control in the UK, import and export rules has become stricter: after products have valid customs declaration forms and pass customs clearance, it is now necessary to declare the suppliers and change the commodity code. The EURATEX calls for effective cooperation between the EU and the UK to solve the problems currently hindering the smooth trade in the EU— UK trade agreement.

China has become Britain's largest import market

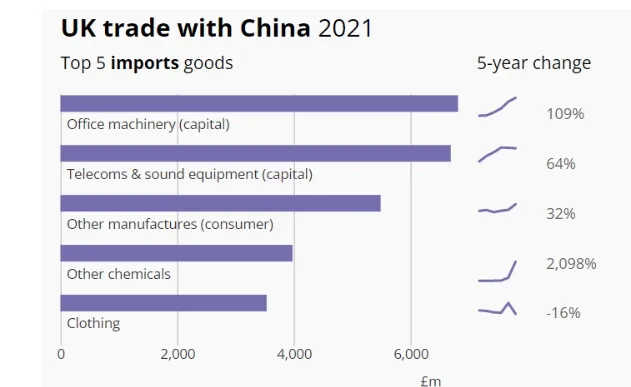

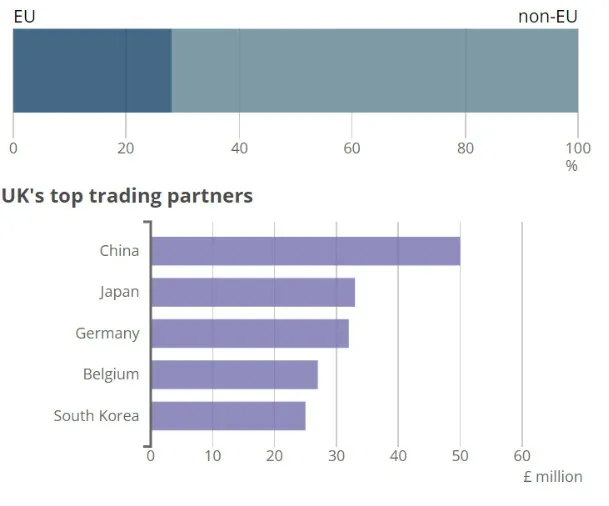

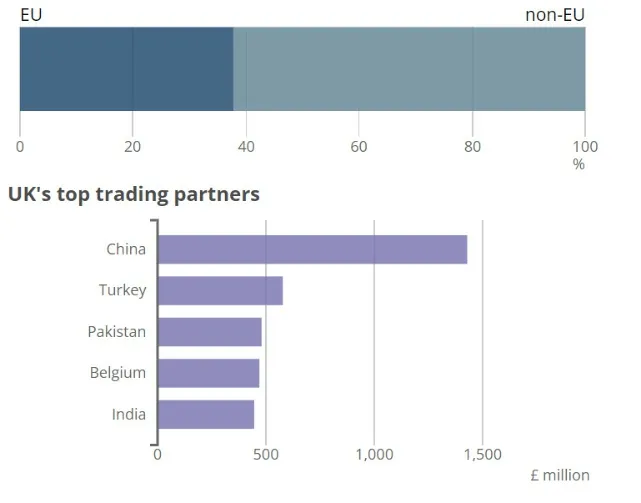

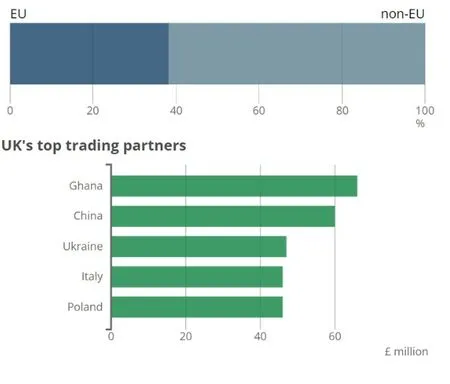

According to the National Bureau of Statistics, in 2021, China has surpassed Germany to become the larg—est import market in the UK. From January to February 2022, exports to the UK continued to grow by 7.4%. In 2021, Britain imported the top five commodities from China (See Figure 1), among which clothing ranked fifth. In 2021, Britain imported 451 million pounds of textile fi—bers (See Figure 2), 5.854 billion pounds of textile fabrics (See Figure 3) and 16.992 billion pounds of clothing (See Figure 4).

From the perspective of UK’s clothing imports (Figure 4), middle and low price garments are mainly imported, with China, Bangladesh, Turkey, Italy and India as major importers. Its main export markets for high—end clothing include the United States, Ireland, Germany, South Korea and the Netherlands. It can be seen that due to the fiercecompetition in the global textile and garment market and the outward migra—tion of European manufacturing and other factors, the UK’s textile and gar—ment production is dominated by small and medium—sized enterprises, which basically abandon the mass production with low value—added and mass product market to ensure a high position in the global value chain.

Figure 1 Top five imports goods from China in 2021

Figure 2 UK’s top trading partners in textile fiber imports in 2021

Figure 3 UK’s top trading partners in textile fabrics imports in 2021

Figure 4 UK’s top trading partners in clothing imports in 2021

Figure 5 UK’s top trading partners in textile fiber exports in 2021

Figure 6 UK’s top trading partners in textile fabrics exports in 2021

With the recovery of global demand, it is expected that Britain's textile and clothing trade deficit will further widen in the coming years. It is foresee—able that Britain will continue to strengthen industrial technology research, strengthen brand strength and maintain its own technological and brand advantages. However, with the increasingly fierce competition of global com—prehensive national strength with scientific and technological strength as the core, and the negative impact of "Britain exiting from the European Union" on the UK, such as insufficient research funding and loss of researchers, the British government has to assess the situation, formulate an overall industrial strategy for 2030, and strive to build a new model that is more suitable for long—term development.