Government auditing and corruption control:Evidence from China’s provincial panel data

Jin Liu,Bin Lin

aSchool of Business,Sun Yat-Sen University,China

bCenter for Accounting,Finance and Institutions,Sun Yat-Sen University,China

Government auditing and corruption control:Evidence from China’s provincial panel data

Jin Liua,*,Bin Lina,b

aSchool of Business,Sun Yat-Sen University,China

bCenter for Accounting,Finance and Institutions,Sun Yat-Sen University,China

A R T I C L EI N F O

Article history:

Accepted 5 March 2012

Available online 12 June 2012

JEL classification:

D73

G38

M42

Since its foundation,China’s government auditing system has played a very importantrole inmaintaining financialand economic orderand improving government accountability and transparency.Though a great deal of research has discussed the role of government auditing in discovering and deterring corruption,there is little empirical evidence on whether government auditing actually helps to reduce corruption.Using China’s provincial panel data from 1999 to 2008,thispaperempiricallyexaminestheroleofgovernmentauditinginChina’s corruptioncontrolinitiatives.Ourfindingsindicatethatthenumberofirregularities detected in government auditing is positively related to the corruption level inthatprovince,whichmeansthemoreseverethecorruptionisinaprovince,the moreirregularities ingovernmentaccounts arefoundbylocal auditinstitutions. Also,post-auditrectificationeffortisnegativelyrelatedtothecorruptionlevelin that province,indicating that greater rectification effort is associated with less corruption.Thispaperprovidesempiricalevidenceonhowgovernmentauditing cancontributetocurbingcorruption,whichisalsohelpfulforunderstandingthe roleofChina’slocalauditinstitutionsingovernmentgovernanceandcanenrich the literature on both government auditing and corruption control.

Ⓒ2012 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

China has achieved remarkable economic success since initiating the reform and opening-up policies in 1978.However,as the reform of economic institutions,power decentralization,privatization and openingup policies progress,corrupt activities such as embezzlement,bribery,kickbacks,power-for-money deals and seeking private ends in public causes have also increased in most public sectors.It is estimated that about 4-8%of GNP is depleted by corruption(Hu and Guo,2001;Gong,2010).Corruption is a difficult problem that hampers economic development,political democracy and social harmony in China(Zhou and Tao,2009; Gong,2010).Many studies on the determinants of and factors affecting corruption find that corruption is always related to discretional power,incomplete or weak legal institutions and inadequate supervision(Zhou and Tao,2009;Gong,2010).Among others,the public finance sector is particularly open to corruption because it is granted many financial power advantages in terms of taxation,budgeting,government procurement and the management of state assets.

Government auditing,the fundamental purpose of which is to monitor,ensure and appraise the accountability of government,is an important institutional arrangement in modern government governance.By monitoring the operation of public power,especially how public resources are used,government auditing can strengthen accountability and reduce the abuse of power and resources.The governance practices of many countries also indicate that government auditing can play a unique role in curbing corruption.On the one hand,auditors are experts in detecting fraudulent financial reporting,which makes them effective in investigating the underlying corruption.On the other hand,the deterrent effect of government auditing can be intensified by making auditing results known to the public and holding the individual bureaucrats who are concerned responsible(Hu,2005;Gong,2010).If corruption is a“virus”that harms economic security and social harmony,then the government auditing system is supposed to be the“immune system”that detects, resists and weeds out the virus.

The governance roleof auditing andthedeterminants andmotivationsofcorruptionarediscussedseparately in many studies.However,research on corruption mainly focuses on power-for-money deals and briberyin economic and banking areas,while little attention is given to corruption in public finance(Li and Zhuang,2009). Meanwhile,studies on how to curtail corruption seldom pay specific attention to the role of auditing.Conversely,theliteratureongovernmentauditingprimarilyfocusesontheindependence,professionalismandauditing input of government auditing agencies and how these factors affect the reputation and efficiency of government departments(Raman and Wilson,1994;Saito and Mcintosh,2010,etc.).Only a few studies touch upon the relationship between government auditing and corruption(Blume and Voigt,2011;Olken,2007). However,none of these studies answer the question of how government auditing may help to curb corruption.

Unlike that in developed countries in Europe and North America,government auditing in China is part of the governance institution and is characterized by strong administrative properties.Nevertheless,there is little evidence on whether China’s audit system plays a different role from its counterparts in western countries.As a part of the overall government administration regime,China’s government auditing system undoubtedly has some administrative power.To be specific,government audit institutions in China are not only supposed to detect and report1Here,“report”means to report the audit results to leading government officials,the higher audit institution and other related departments.Audit results at the local level,especially the municipal and county level,are not always disclosed publicly in the sample period.irregularities and violations that may exist in government accounts and statements,they are also authorized with the power to impose administrative sanctions and penalties on the responsible agencies and individuals who violate the laws and regulations.They must also ensure that all irregularities are corrected and all violations are punished accordingly.Even though China is a big country with multi-tier administrative units,local government plays a crucial role in the country’s economic and social development and is undoubtedly controlling a certain portion of government resources.According to statistics,the US federal government owns the control rights on about two-thirds of the nation’s government funds,whereas in China,public expenditure at the local level accounts for more than two-thirds of all public spending.2For example,local fiscal expenditure accounts for 68.5%of China’s whole fiscal expenditure in 1999 and 78.7%in 2008.Data is from the China Economic Information Network Database(http://db.cei.gov.cn/).What’s more,due to China’srelatively weak budget control mechanisms,China’s local government actually has quite a lot of discretionary power over public revenue and expenditure.Therefore,supervising how local government officials are using their power and how public money is managed is vital and urgent,yet there are few studies and little evidence on the governance role of China’s local audit institutions.

Building on the literature and taking China’s special institutional setting into consideration,this paper tentatively explores the rectification and prevention role of China’s local audit institutions in addition to its discovery role against irregular and corrupt behavior.We demonstrate empirically that China’s government auditing has worked actively and effectively in discovering irregularities and preventing corruption,and therefore can help to improve government accountability and transparency.To be specific,this study employs a sample of local government audit institutions in China’s 31 provincial administrations from 1999 to 2008. Taking corruption cases committed by public officials and filed by the judicial organs in each province as a measure of the severity of corruption,we empirically examine the role of government auditing in the fight against corruption from two perspectives:the fraud detection effort in government auditing and the rectification effort after audits.Our main findings indicate that:(1)local audit institutions can detect and report violations and misbehavior in the income and expenditure of government funds,and the number of violations and irregularities is positively related to the intensity of bureaucratic corruption in that province.However, the detection and reporting of violation and irregularities does not significantly decrease corruption;and (2)the implementation of sanctions,penalties and other audit decisions has a deterrent effect on the audited bodies,which indicates that increasing rectification effort in the present period will result in less corruption in the following period.

This paper makes several contributions to the literature.First,based on the supervision and appraisal role of government auditing,we carefully examine the relationship between the fraud detection effort of government auditing and the degree of corruption in each province,and provide empirical evidence on the revealing role of government auditing.Then,focusing on the specific properties of China’s government auditing system, we tentatively examine whether the post-audit rectification effort can strengthen the deterrence power of government auditing and empirically demonstrate that rectification results are negatively related to the degree of corruption in the lagged period.Finally,unlike previous studies on corruption that pay little attention to audit institutions and previous discussions on the role of government auditing in curbing corruption that lack empirical support,our research provides direct evidence on the role of government auditing in the fight against corruption.Our research not only enriches the literature in these two areas,but also provides some far-reaching implications for China’s government auditing practice and corruption control initiatives.

The remainder of the paper is organized as follows.Section 2 reviews the literature on government auditing and corruption.Section 3 discusses the institutional background,theoretical analysis and research hypotheses. Section 4 describes the sample,data and variables.Sections 5 and 6 present the empirical analysis on the relationship between government auditing and corruption.Section 7 concludes the paper.

2.Literature review

2.1.Government auditing

Classic audit theory states that audit quality is the probability that the auditor will both discover and report a breach in the client’s accounting system(DeAngelo,1981).When it comes to government audit,Zhao(2005) proposes a fairly complete characteristic framework that divides the factors related to the quality of government audit into three categories:technical factors(professional competence,auditor size and audit hours), independence factors(audit fee,auditor reputation and the organizational design of audit institutions)and administrative factors(determining the nature of irregularities,making the right decisions and checking on rectification results).Of these,administrative factors are unique under the special setting in China.In empirical studies,researchers often use one aspect of these characteristics as a proxy measurement of government audit quality.For example,Saito and Mcintosh(2010)employ time spent in auditing as a direct measure of auditing effort.Ma(2007)reports that educational background,experience and professional competence are significantly related to the financial efficiency of government auditing.Blume and Voigt(2011)document that the mandate,independence and institutional environment of the state supreme audit institutions can exertstrong influence on their effectiveness.Melo et al.(2009)demonstrate that both political competition and frequency of power alternation affect the independence of the audit bodies and thus are significantly related to the activism and autonomy of the latter.Considering China’s special setting,Huang and Wang(2010)and Wei et al.(2010)argue that the“correction”or“rectification”effort made by the audit institutions and related parties after problems are recognized is the most important factor in determining the extent to which government auditing can perform its duties and promote government transparency and accountability.

Numerous studies have also been conducted on the economic consequences of government auditing.Many researchers discuss the important role that government auditing plays in the public sector.For example, Raman and Wilson(1994)find that government auditing procurement practices affect the price of seasoned municipal bonds.Saito and Mcintosh(2010)examine audit efficiency in public school operations and document that state auditors can enhance efficiency in the use of school resources.Both Schelker and Eichenberger (2010)and Blume and Voigt(2011)indicate that government auditing can improve the transparency of public policies and reduce wasteful spending.Olken(2007)conducted a field experiment on the monitoring effect of government auditing in Indonesia and documents that when the probability of village road projects being audited by government increased from 4%to 100%,corruption(over-spending)on these projects decreased by 8%.Similarly,Ferraz and Finan(2008,2010)find that government auditing reports can reveal corrupt activities,which then affect political election results.Several studies have explored the effectiveness and efficiency of government auditing in China.For instance,Wei et al.(2010)discuss how sanctions and penalties, the transferring of cases and clues and the submission of audit reports and newsletters affect the operational security of public financial funds.Li et al.(2011)examine whether government auditing,especially economic accountability auditing,can prevent government officials and CPC party members from corruption.

Previous studies on government auditing conducted in both China and internationally are useful in understanding the role of government auditing in government governance,including the establishment of public accountability,control of corruption and promotion of government efficiency.Building on these studies, we argue that government auditing results should be read and explained dialectically.Although the irregular or illegal activities detected in government auditing to some extent reflect audit effort or quality,they are basically a reflection of the irregularities or corruption problems in the public financial sector.Therefore,we investigate both the relation between irregularities detected in government audits and provincial corruption,and the relation between rectification effort and provincial corruption.This paper not only answers whether government auditing can prevent or reduce corruption,but also provides empirical evidence that the rectification effort following an audit is critical to guaranteeing the power of government auditing.Government auditing can only act as a strong deterrent to corrupt activities if adequate effort is made to rectify malpractice in the collection and spending of government funds and by ensuring that all audit decisions and suggestions are carried out completely.Otherwise,government auditing will be worthless.

2.2.Corruption

Corruption is a significant problem that harms the economic development and social stability of many countries.Consequently,studies on the roots and consequences of corruption and its counter-strategies are hot economic,management and social topics.From an economic point of view,corruption is rooted in the existence of privileges and incomplete market mechanisms.Privileges are always accompanied by government regulation.The government’s broad intervention in economic activities and multi-tier approval procedures provides enormous opportunities for rent-seeking(Shleifer and Vishny,1993;Sun et al.,2005).Adit(2003) identifies three necessary conditions for corruption to arise and persist:discretionary power,economic rents, and weak institutions.While the arbitrary nature of power makes rent-seeking possible,the lack of a strong institution makes public officers with supreme authority fearless in extracting and creating rents.Although corruption may be efficient under some extreme conditions,3Adit(2003)quotes the example suggested by Lef f(1964),that corrupt bureaucracies to some extent solved the inflation problems in Chile and Brazil in the early 1960s.there is ample evidence to suggest that it is extremely harmful.The direct consequences of corruption are the wasting of resources,low efficiency in resource allocation,reduced investment and low economic growth(Shleifer and Vishny,1993;Yang and Zhao,2004).Corruption,then,leads to a distorted public spending structure.Corrupt officials tend to increase spending on construction projects and decrease spending on science,education,culture and health programs,because it is easier to extract from construction projects(Mauro,1998;Wu and Yao,2008).In addition,corruption represents a form of income redistribution without transparency,which increases the gap between the rich and poor,and is certainly against social fairness and justice(Chen and Li,2010).In summary,corruption distorts the functions of government and market mechanisms.It makes it difficult to build economic order,slows down economic development and harms social stability.

As the increase in corruption has profound institutional roots,the proposed counter-strategies inevitably include institutional reform.Sun et al.(2005)point out that an effective way to fight corruption is market construction.Once a more perfect and complete market is built,there will be less space for rent-seeking.Cheng and Sun(2006)conclude that Pinochet’s economic reforms in the 1970s successfully got Chile out of the quagmire of corruption.The reforms reduced government intervention and increased reliance on the market to allocate resources.Besides market construction,another important anti-corruption strategy is to increase supervision,which relies heavily on a country’s special supervisory systems,particularly the judiciary system and audit system.However,special supervisory systems are also easy to corrupt,so the effectiveness of supervision depends largely on the independence of the professional supervisory agencies(Svensson,2005).Paying higher wages to public officials is another widely used anti-corruption strategy.More competitive pay will encourage public officials to value their reputation and hesitate before becoming involved in illegal activities (Di Tella and Schargrodsky,2003).Recently,there has been an increasing realization that improving information disclosure and giving citizens greater rights to decisions can be effective in reducing corruption.For example,Reinikka and Svensson(2005)report that since the Ugandan central government started publishing newspaper accounts of the education funds allocated to primary schools,the local capture of education funds has reduced significantly and student enrollment and learning have improved considerably.Yet public enforcement or monitoring may also cause free-riding problems and can be easily manipulated by the elites (Olken,2007).Comprehensive strategies that combine market construction,stronger supervision by the judiciary and audit systems,and open budget reform and transparent decision-making are widely applied in the battle against corruption in many places across the world.

A government auditing system is an indispensible part of the whole political and economic institution,and its fundamental goal is to supervise and check the balance of public power.Government auditing is supposed to be an active force in the global anti-corruption campaign,yet previous studies provide little empirical evidence on the relationship between government auditing and corruption control.Unlike numerous studies that seek fundamental institutional reform and market improvement to curtail corruption,this paper tentatively examines one of the professional accountability mechanisms:the government auditing system for special concerns.

3.Institutional background and theoretical analysis

3.1.Institutional background

China’s current government auditing system was developed in the early 1980s.Until then,the supervision of public power and bureaucracies mainly depended on the internal supervision of the Party and the personal loyalty of public officers,and the role of audit was politically and administratively marginalized(Gong,2009). The China National Auditing Office(CNAO)was founded in 1983,followed by the establishment of its resident offices in state ministries and commissions and in certain regions,with corresponding audit institutions at provincial,municipal,and county levels.The CNAO,together with its resident offices and corresponding local institutions,formed a structured multi-tier government auditing system with wide coverage.In the 1990s, government auditing work was further legalized and standardized with the successive promulgation of the Audit Law of the People’s Republic of China,the Regulations for the Implementation of the Audit Law of the People’s Republic of China and a series of auditing standards and other regulations.However,it was the“audit storm”sparked by the announcement of audit results to the public in 2003 that made government auditing widely known to the public in China and around the world.The role of government auditing in“detectingviolations and combating corruption”was largely strengthened as a result of this storm.After more than 20 years of development,China’s government audit institutions have become one of the most important institutional arrangements for supervising the use of government funds,maintaining national fiscal and economic order,and promoting government transparency and accountability.

Along with continuous improvements in government auditing,a theory of audit systems and core values of audit institutions have also developed.Before the introduction of the Audit Law and the Regulations for the Implementation of Audit Law,the legal framework of government auditing was neither complete nor perfect and the core missions of the audit were unclear.Thus,for a long time government audit institutions mainly acted as financial supervision agencies.The financial and economic supervision function of government auditing was only truly established after the promulgation of these two laws and regulations.Former General Auditor Li Jinhua pointed out that the essence of government auditing is“a tool that promotes democracy and the rule of law,”and put forward the concept that an audit is the“watchdog”of state property.The present General Auditor Liu Jiayi inherited the idea that auditing should promote democracy and the rule of law,and further proposed that beyond acting like a“watchdog,”audit institutions should be the“immune system”that safeguards the security of the entire social,economic and financial system.As an“immune system,”government auditing should be sensitive to all risks and“viruses”that may hinder economic and social development. Both the“watchdog”theory and the“immune system”theory stress the detecting,revealing and resistance functions of the government auditing system,but the“immune system”theory places more emphasis on the prevention and restoration role than on the detection of irregularities.

Unlike developed Western countries,China adopts an executive mode of government auditing.According to China’s Constitution and Audit Law,audit institutions exercise supervision through auditing of government departments,state-owned monetary institutions,enterprises and other institutions,but the audit system itself is a part of the executive branch of the state,which means the supervisor and the supervisee are not fully independent of each other.At the state level,the CNAO is directly under the leadership of the Premier,whereas the local audit institutions are under the dual leadership of the administrative heads of their correspondinglevel governments and the audit institutions at the next-highest level.When their work is mainly directed by the next-highest audit institution,personnel affairs and audit funds are decided by the corresponding government,which makes local audit institutions even less independent(Zheng and Yin,2010).However,China’s government audit system also has some very special and important properties:besides carrying out investigations and making recommendations,the audit institutions are authorized to impose administrative sanctions and penalties4According to article 41 of the Audit Law of the People’s Republic of China,“Where violations of State regulations governing government and financial revenues and expenditures should be dealt with or punished in accordance with law,it shall,within the limits of its statutory functions and powers,make an audit decision or put forward to the department in charge its suggestions as to how to deal with or punish the violations.”Article 45 further specifies the measures that should be taken,including ordering the audited units to turn over what should be turned over and returning their illegally possessed state-owned assets and unlawful gains,to deal with the matters concerned in accordance with the uniform regulations of the state governing the accounting system and to take other measures.on the audited bodies,check on rectification results and force audited bodies to make sufficient rectifications.Thanks to these special properties,the functions of the government audit institutions in China are not limited to fraud detecting and reporting,but include rectification of any irregular or illegal acts in economic and fiscal operations(Feng,2005;Zhao,2005).

Corruption has become a huge problem that concerns many countries worldwide.The key to combating corruption is to eliminate privileges and strengthen government accountability.Therefore,many countries and organizations have put forward government audit institutions in the battle against corruption.For example,the USA introduced a Government Accountability Office(GAO)and Brazil established audit courts.China’s government auditing system has a unique arrangement that differs from its counterparts in developed western countries.Furthermore,China’s local audit institutions differ from the CNAO in many ways. Although a few empirical studies have examined the role of government auditing,few people are aware of the role of China’s local audit institutions.As China’s local governments are very important in China’s political and economic system and corruption in local government is so severe,it is important to explore the role of local audit institutions in the war against corruption at the local level.

3.2.Theoretical analysis and hypothesis development

3.2.1.Detection of irregularities and exposure of corruption

The most important function of government auditing is to determine whether the process of collecting and spending public funds and other relevant transactions is in line with state laws and regulations,to determine whether there is any misbehavior in the management of public revenue and expenditure,and to disclose any irregularity that harms government accountability in the audit report.According to China’s Audit Law,audit institutions should supervise by auditing the authenticity,lawfulness and efficiency of the government,or the financial revenues and expenditures of the audited bodies,among which the supervision of authenticity and lawfulness is the basis for the supervision of efficiency.Meanwhile,as the criteria for evaluating the efficiency of government or financial revenue and expenditure have not yet been developed,for the past twenty years or more,government auditing in China has been concerned mainly with the supervision of authenticity and lawfulness.As shown in the audit reports that have been publicized in recent years,local audit institutions can discover and expose misbehavior that violates laws and regulations,are against standards and guidelines, or waste resources.

Corruption is the misuse of public office for private gain.Misuse always involves comparison with a legal standard.Typical corruption includes the illegal sale of government property,kickbacks in government procurement and bribery and embezzlement of government funds(Shleifer and Vishny,1993;Svensson,2005). Due to the secretive nature of corruption and the various forms it takes,to control corruption professional agencies first need to identify and discover corrupt activities.Government auditors are proficient at detecting fraud in financial statements and the misuse of government properties and are therefore determined to work actively in detecting corruption(Gong,2010).The number of irregularities found in government auditing to some extent reflects whether audit institutions are diligent in fraud detection,but more importantly,it reflects how public resources are misused by government sectors and related departments.Some researchers have used the misbehavior detected in government auditing to measure the diligence or effort of audit institutions(Ma, 2007;Li et al.,2011),but other researchers treat it as a direct measure of corruption(Melo et al.,2009;Pereira et al.,2009;Ferraz and Finan,2008,2011).When audit institutions are highly independent and the audit work is highly technical and impartial,irregularities or violation cases reported by audit institutions can be used as a good measure of government corruption(Melo et al.,2009;Ferraz and Finan,2011).However,in this paper, we do not equate the irregularities found by audit institutions to corruption.Instead,following previous literature(Glaeser and Saks,2006;Zhou and Tao,2009;Wu and Rui,2010),we apply corruption cases committed by public officials in each province to measure the severity of corruption.On the one hand,the audit institutions are not fully independent from the executive branch in China and corruption investigation is not the primary goal of government auditing.On the other hand,according to audit reports and other data, the problems found by government audit institutions are always conducted by a department,which differs from corruption cases committed by individual public officials.However,the close relationship between irregularities found by audit agencies and corruption cases filed by judicial organs in the same place is also undeniable.Generally,corruption cases and irregularities both reflect the quality of government governance.In a place with severe corruption,there is likely to be more irregular or illegal activities that are traceable in government financial accounts and statements,which should be noticed by professional,diligent and responsible government auditors.Otherwise,if an audit institution cannot discover or report clues and traces left by corrupt bureaucrats,it cannot be regarded as having fulfilled its supervising responsibilities.Therefore,we propose the following hypothesis:

H1.The number of irregularities detected by local audit institutions is positively related to the severity of corruption of public bureaucrats in a province.

3.2.2.Post-audit rectification and corruption

The number of irregularities detected in government auditing is a reflection of how many violations exist in government operations.However,an audit report disclosing these irregularities is far from sufficient to deter corrupt bureaucrats and their potential followers.The key to curbing corruption is accountability.That is,to curb accountability it is important to determine the rights and responsibilities of each government department,related state-owned institutions and individual public officials,and to impose sanctions and penalties when the rights are not exercised in line with the relevant laws and regulations and when the responsibilities are not fulfilled accordingly.Therefore,the detection of irregularities in government auditing is only the first step and the second step of“asking for responsibility and making correction”is more important.It is only through the complete and timely enforcement of audit decisions—sanctions,penalties and suggestions for dealing with or punishing violations and improving management—that the deterrent effect of government auditing can be guaranteed.Otherwise,audit decisions will represent a worthless piece of paper and violations and wrongdoings will occur again and again.

To fulfill the mission of a government audit system,there must be an“asking for responsibility”step after violations and irregularities are identified by auditors.Klitgaard(1998)proposes a well-known model to explain the dynamics of corruption:corruption=monopoly power+discretion-accountability.Adit (2003)also points out that discretionary power,economic rents and weak institutions are the three necessary conditions for corruption to arise and persist.Both of these views indicate that corruption is rooted in the excessive power of government departments and public officials,together with a lack of supervision,whereas the strengthening of accountability regimes can reduce corruption.Compared with other accountability regimes,government auditing lays its expertise in the system of checks and balances and fraud detection. The check and balance of power must first determine where the problems are and who is responsible for those problems.All illicit or irregular acts are traceable in financial deals and accounting records.Auditors have long been familiar with the financial system and accounting books,and thus can play a unique role in fraud detection and corruption control(Gong,2010).The World Bank considers the national audit office or the supreme audit institute as the linchpin of a country’s integrity system,because an audit can help to:(1)curb corruption and act as a potent deterrent to waste and the abuse of public funds;(2)reinforce the legal,financial and institutional framework;(3)establish the predictability of government behavior and law,and reduce arbitrariness in the application of laws and rules;and(4)expose non-transparent policies against the public interest(Dye and Stapenhurst,1998).However,all of the roles supposed to be played by the auditors depend on a powerful government system with effective accountability mechanisms(Gong,2010).

China’s government auditing system is essentially“a tool that promotes democracy and the rule of law,”which aims to improve the transparency and accountability of government by exercising supervision of the revenues and expenditures of government sectors and other related institutions.Corruption is a chronic cancer that harms the transparency and accountability of government,and is inevitably the target for audit institutions to dig out,fight against and prevent from happening repeatedly.Compared with developed western countries,China has both a weak institution and a weak accountability system.However,China’s audit institutions are authorized to impose administrative sanctions and penalties on audited bodies wherever illegal and irregular deeds are uncovered.In another words,in addition to detecting and reporting malpractice and misbehavior,China’s audit institutions can punish and rectify them.Audit institutions are involved in the rectification process in several ways.They can:(1)impose sanctions and penalties directly;(2)transfer cases to the parties in charge and make suggestions on the sanctions and penalties that should be imposed;(3)make suggestions on how to repair de ficiencies in government administration and how to perfect government institutions;and(4)check on the implementation of audit decisions and the recti fication results.Recti fication is more important than fraud detection and reporting,because it is only by punishing violations and correcting misbehavior in time that economic and fiscal order can be maintained and government transparency can be achieved.The results of rectification measures following an audit can reflect the supervisory effectiveness of government auditing and are essential in determining whether the audit system can reduce corruption.Therefore,we propose the following hypothesis:

H2.The more rectification effort made following government auditing,the more effective local audit institutions will be in reducing corruption.

3.2.3.Other factors

3.2.3.1.Factors affecting auditing and rectification results.Audit amount is the amount of funds audited by audit institutions.We use irregularities found in government auditing as a measure of auditors’detection effort.However,the number of irregularities is closely related to the total amount of funds audited.Otherthings being equal,the more departments and projects involved in the auditing process,the more irregularities there are to be found.Though the specific amount audited by each local audit institution is unavailable,we can use the total amount offiscal revenue and expenditure as a proxy,as the fiscal revenue and expenditure of local governments is the main compulsory object of supervision for audit institutions at the corresponding level.

Auditor is the most important resource in government auditing.Whether an audit institution can finish its tasks with high quality is largely dependent on the number,professional competence and independence of the auditors(Zhao,2005;Ma,2007;Li et al.,2011).Other things being equal,an audit institution with more independent and more experienced auditors tends to be more capable of detecting misbehavior,making correct decisions and providing rectification suggestions.However,due to data availability,we can only use the number of employees of the provincial audit office as a proxy.

Reports and newsletters delivered by local audit institutions contain summarized information on problems found in auditing,suggestions for management improvements and solutions for rectification,which are informative and important(Huang and Wang,2010).When these reports and newsletters are instructed or adopted by leading government officials,higher audit institutions or related departments,the auditors who prepared this information will be encouraged and audited bodies will be under greater pressure to rectify misbehavior and improve management.Therefore,under the same conditions,a higher adoption rate of reports and newsletters delivered by local audit institutions may bring about more diligent audit teams and better rectification results.

Financial solvency of local government is another important factor.The post-audit rectification results,especially rectifications concerning money,are largely dependent on the local government’s financial solvency.As some rectification reports state,a major reason that many audited bodies do not carry out rectification decisions or do not fulfill all rectification solutions is a lack offinancial solvency.Following related literature,we use provincial revenue per capita and the expenditure-revenue ratio as a proxy for the financial solvency of local government.

3.2.3.2.Factors affecting corruption.Market development is perceived to be the key solution for chronic corruption problems.The root of corruption lies in the incompleteness and imperfection of markets and the law.Hence,market development that contains institutional reform and legalization and leads to less government intervention in the economy is fundamental to eradicating corruption(Sun et al.,2005;Cheng and Sun, 2006).Zhou and Tao(2009)take the development of a non-public ownership economy as an indicator of market development,which is also supported by Wu and Rui(2010).Following previous studies,we predict that provinces with higher market development will be less corrupt.

Education or human capital has been shown to be an important factor related to corruption.For instance, Glaeser and Saks(2006)find that places with higher education and income are less corrupt.Education and income status also differ across provinces in China.Following Wu(2010),we use the average number of years of education beyond the age of 6 to measure the education level in a province.

Wageof public officials is found to be an important factor affecting bureaucrats’motivation,therefore“high salary for transparency”is an important policy adopted by many countries in preventing corruption.Referring to Wu and Rui(2010),we use the relative wage of public officials to capture this factor.

Size of government is a controversial factor.Fisman and Gatti(2002)find that a larger government is related to less corruption,whereas Ali and Isse(2003)report the opposite.Using provincial data from China, Wu(2010)finds a negative relationship between government size and corruption cases,whereas Zhou and Tao (2009)report a positive relationship.Following this literature,we use the ratio offiscal expenditure to GDP in each province to measure local government size.

Openness measures the presence of barriers to international trade and capital flows,which may be caused by collusive behavior between individuals and customs officials(Gatti,2004).Some international studies suggest that countries that are more open tend to be less corrupt.Zhou and Tao(2009)also find that provinces with high imports and exports tend to be less corrupt in China.Therefore,we also control for the level of openness when examining the determinants of corruption.

4.Sample and data

4.1.Sample selection

This paper examines the relationships between irregularities detected in government auditing,post-audit rectification and the severity of public corruption at the provincial level.Our sample period is from 1999 to 2008.As a government audit may have a lagged effect on government corruption,data related to irregularities detected in and rectification taken after government auditing are collected from 1999 to 2008,whereas other data is from 2000 to 2008.Our sample period starts in 1999 because China’s government auditing system experienced a long period of development and become relatively standardized and perfected by the late 1990s,and the Yearbook of Auditing in China began to disclose detailed information about the irregularities,sanctions and penalties,and rectification results of provincial government auditing in 1999.Data related to government auditing is primarily collected from the Yearbook of Auditing in China and is complemented by internet searches for missing observations.Other data is from the China Statistical Yearbook and China Economic Information Network Database.

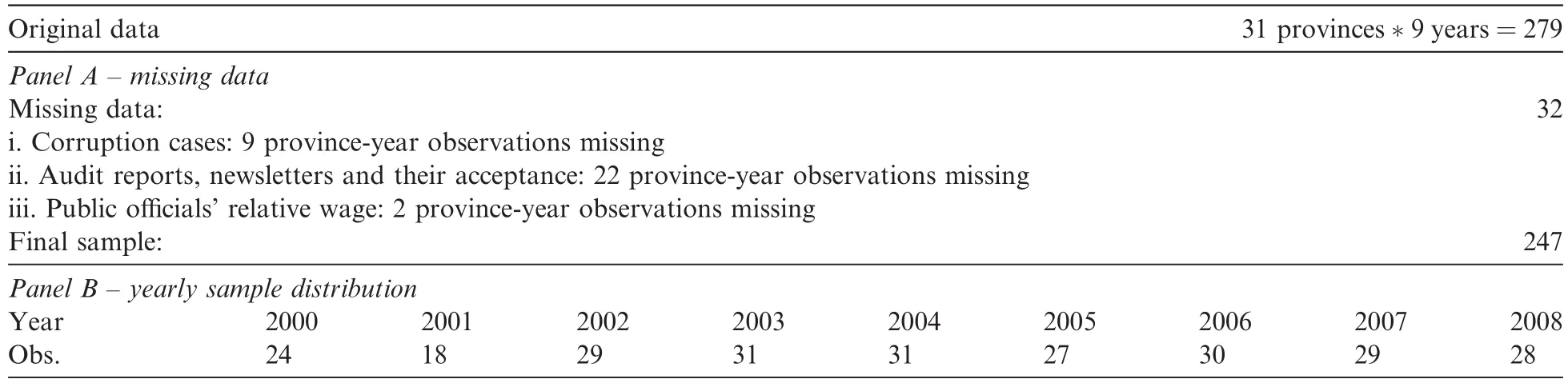

Table 1 describes the sample selection process and its distribution across the sample period.The original sample includes 279 observations.However,there are 32 missing observations,thus the final sample contains 247 observations.Meanwhile,due to the unavailability of some dates,the sample distribution from 1999 to 2008 is not completely balanced.

4.2.Data description

Table 2 describes the irregularities detected in government auditing,the post-audit rectification results and other related information on government auditing.As shown in Panel A,on average about 4465 government departments,state-owned monetary institutions,enterprises and other institutions are audited(the auditees) by the local audit institutions per province-year.An average of about 6 billion RMB(hereafter all RMB)relating to irregular or illegal activities is detected,which means that on average there are 1.88 million in irregularities found per audited unit per province-year.We make an adjustment for the population size of each province and find that the average amount of irregularities is about 184.15 per capita.The amount of irregularities accounts for 6.34%of the financial revenue and expenditure per province-year,which means that 6.34%of government funds is not collected or expended in accordance with related laws and regulations.

Panel B of Table 2 describes how sanctions and penalties are implemented and how many cases and clues are transferred to the judicial organs(including the courts and procuratorates),supervisory departments and other related departments.The table shows that the average amount that should be turned into the treasury, returned to the original fund channel or deducted from grants or subsidies is about 1948.78 million,whereas an average of 1119.53 million was actually turned over,returned or deducted.The average rectification rate is about 57.35%.Besides administrative sanctions and penalties,the audit institutions transfer severe cases that may violate related laws and regulations to related departments.As indicated in the table,on average,23,40,and 9 cases are transferred to the judicial organs,the supervisory departments and other related departments, respectively,and less than nine clues transferred to the judicial organs are filed per province-year on average. The median rate of cases and clues filed is 48.45%,which is not far from the 42.5%reported by Huang and Wang(2010).5The sample period of Huang and Wang(2010)is from 2002 to 2006.In addition,there are about 1212 cases relating to corrupt acts filed by the local procuratorial organs in each province every year.Of these,clues transferred by local audit institutions represent only a small proportion.In view of these descriptive statistics,it may be reasonable to infer that the power of the government audit institution and its deterrent effect lie mainly in the imposition of administrative sanctions and penalties,rather than the transfer of clues.

Table 1Sample distribution.

Panel C of Table 2 summarizes the auditing reports and newsletters delivered by local audit institutions and how these reports and newsletters are adopted by leading government officials and related departments. Unfortunately,there is some missing data,but the information in Panel C may still be informative.As the table shows,an average of 3245 auditing reports and newsletters are delivered by the audit institutions per province-year.Of these,1644 are instructed or accepted by the higher audit institutions,leading government officials and other concerned departments,thus the average adoption rate is about 46.47%.The human resources and financial resources put into government auditing are also very important.However,because the detailed recruitment and budget information of audit institutions at municipal and county levels is unavailable,we use the number of employees in the provincial audit office as a proxy.The average number of auditors in a provincial audit office is 189.The number of employees varies widely between provinces.For instance,the minimum number of employees in the Xin Jiang audit office in 1999 is 50 and the maximum number in the Beijing audit office in 2007 is 594.When compared with the overall number of public officials,we find that, for each 10 thousand public officials,there are less than 8 government auditors,on average.

Table 2Irregularities detected in government auditing,rectification results and other related information.

Fig.1 shows the time trend of corruption during the sample period in China.Two proxies measuring the degree of corruption are used.One is the corruption cases filed by the procuratorial organs(adjusted by population size,cases per 10,000 residents)and the other is the corruption perceptions index(CPI)scores evaluated by Transparency International(a higher score indicates more transparency and less corruption). Transparency International is a global civil society organization leading the fight against corruption and the CPI is one of the most authoritative corruption measurements in cross-country studies.Fig.1 shows a slight decrease in corruption cases filed from 1999 to 2008.The CPI scores demonstrate a slight increase in the same period,which also indicates a small decrease in corruption.In other words,Fig.1 suggests a significantly negative correlation between the amount of corruption cases filed and the CPI scores,and the trends in these two measures are consistent.Therefore,corruption cases filed may be a reasonable and feasible proxy for local government corruption(as local level CPI is unavailable).

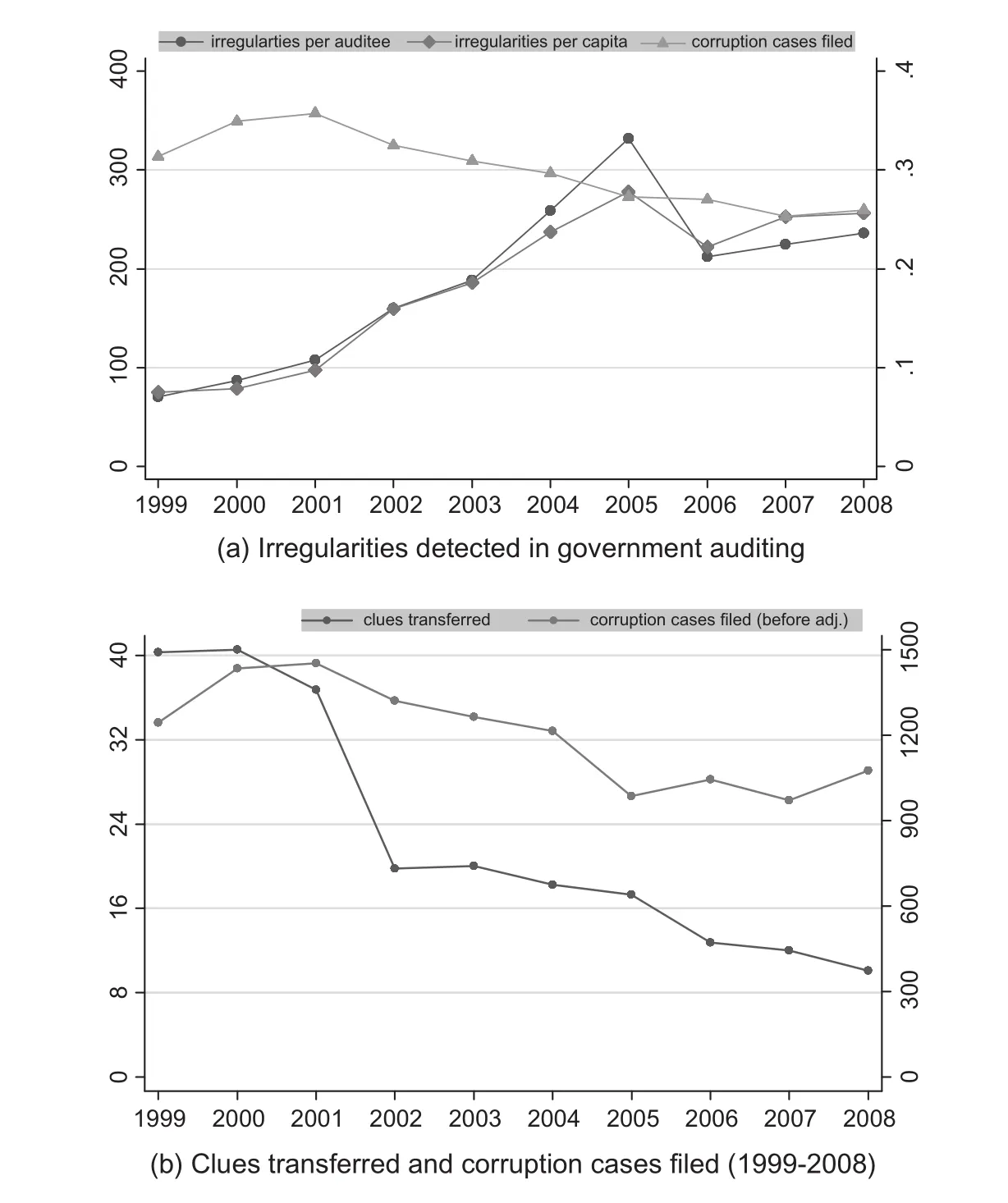

Fig.2 describes the time trend for irregularities found in government auditing,clues transferred to the judicial organs after audit and corruption cases filed by the local procuratorial organs.Fig.2a shows the time trend for the number of irregularities per auditee,irregularities per capita and corruption cases filed per 10,000 residents.As the figure shows,the number of irregularities per auditee and per capita both present a significant increasing trend,whereas the number of corruption cases filed per 10,000 residents shows a slightly decreasing trend in the sample period.We provide two explanations.First,the increase in the number of irregularities is consistent with the growth in the whole economy and the government total revenue and expenditure,thus the total audited amount is increasing.Meanwhile,the scope of auditing has expanded and perhaps the detection effort has also increased as China’s government auditing has drawn increasing attention in recent years.Second,the slight decrease in the number of corruption cases filed indicates a slight decrease in corruption in the sample period,which is consistent with the Transparency International’s CPI scores for China (Fig.1).This confirms,to some extent,that as the market development and legalization process continues and the government places more emphasis on government governance,China has achieved a certain level of success in the fight against corruption in recent years.Fig.2b shows a decrease in corruption clues transferred by audit institutions to the judicial organs,which is consistent with the decrease in the overall number of corruption cases filed by the procuratorial organs.This also indicates a decrease in severe violations in the public finance sector,which may be attributable to the effective implementation of government audits in recent years.The audit storm and the subsequent institutional rectifications not only exposed the dark side of government operations to the public,but also pushed the government to make improvements and increase transparency.

Fig.1.Corruption trend(1999-2008).

Fig.3 describes the cross-sectional differences in the number of irregularities detected and corruption cases filed across provinces during the sample period.Fig.3a summarizes the raw data and Fig.3b uses dataadjusted by the population size of each province.Codes 1-12 represent the twelve provinces in the east of China,codes 13-21 the nine provinces in the center and codes 22-31 the ten provinces in the west.As shown in Fig.3,the number of irregularities in accounts and corruption cases filed varies significantly across provinces.Comparing the three regions,we find that there are significantly more irregularities and corruption cases in the east and central regions than in the western region(Fig.3a).However,the regional differences diminish after adjusting for population size(Fig.3b).We also note that more irregularities tend to be detected in provinces with more corruption cases,though the positive correlation is not particularly significant when the two amounts are adjusted by population size.

Fig.2.Irregularities detected,clues transferred and corruption cases filed.

4.3.Variable definitions

This study examines the relationships between the severity of corruption and audit institutions’effort in detecting irregularities,and also between the post-audit rectification effort and the severity of corruption at the provincial level.Following Zhou and Tao(2009)and Wu and Rui(2010),we use cases committed by public officials and filed by the judicial organs to measure the severity of corruption in a province and construct a model of the determinants of corruption.Following Huang and Wang(2010)and Li et al.(2011),we apply irregularities found in auditing rectification results after an audit to measure the two aspects of government auditing and construct models of the factors that determine the detection and rectification of irregularities. Sections 5 and 6 provide details of the model design.Table 3 summarizes the definitions of the variables used in the regression models.

Fig.3.Irregularities and corruption cases in each province across the sample period.

5.Audit detection effort and corruption

5.1.Correlations

The previous analysis suggests that government auditing can detect and discover corrupt acts.In Section 4, we show that the number of corruption cases filed by the procuratorates is significantly related to the CPI scores provided by Transparency International.Some researchers have applied this number as a proxy for the degree of corruption in province-level studies(Zhou and Tao,2009;Wu and Rui,2010).It is noted that corruption cases always involve severe violations of public finance laws and regulations,and corrupt bureaucracies always have severe economic problems that should be noticed by government auditors.In a province with severe corruption,there must be more misbehavior in government operations.When auditors are diligent and responsible,more irregularities will be found and reported.

Fig.4.describes the relationship between audit detection effort and the degree of local corruption by scattering all of the observations in the sample period.Fig.4a uses the amount of irregularities per capita for auditeffort,while Fig.4b uses the amount of irregularities per audited unit.The figure shows a primary positive correlation between the number of irregularities and the number of corruption cases filed.

Table 3Variable definitions.

5.2.Multivariate models

According to the theoretical analysis and prediction in Section 3,the number of irregularities in public financial revenue and expenditure detected by local audit institutions will be significantly related to the degree of corruption in that province.However,there may be reverse causality between audit fraud detection effort and the degree of bureaucrats’corruption.On the one hand,there are always more severe de ficiencies in government operations and adminstration in a more corrupt place,thus the audit institutions will put more effort into detecting misbehavior.On the other hand,the exposure of misbehavior by audit institutions may also put pressure on present or potential corrupt bureaucrats and force the audited bodies to improve their management,thus reducing corruption in the lagged period(Li et al.,2011).In addition,several other factors may affect audit detection effort,such as the audited scope and amount(Amount),the number of auditors(Auditor),the adoption rate of audit reports and newsletters(Rptcyl),market development(Market)and openness (Open).Among these,Market and Open also affect the degree of local corruption.Education(Educ),economic growth(Growth),compensation of public officials(Wage)and government size(Govsize)are also controlled as determinants of corruption.Therefore,we use the following simultaneous equations to test the relationship between audit detection effort and bureacrats’corruption.

Fig.4.Correlation between audit detection effort and the degree of local corruption(1999-2008).

The subscript i denotes the code for each province and t denotes the sample year.Auirr is the log of irregularities detected by government audit institutions in each province,adjusted by population size(irregularities per capita,Auirrp)or adjusted by the number of audited units(irregularities per unit,Auirru).Corrupt is the degree of bureaucratic corruption in each province,measured by the number of corruption cases per 10,000 residents filed by local procuratorial organs in each province,following Wu and Rui(2010).The variable definitions are listed in Table 3 and descriptive statistics are presented in Table 4.

5.3.Empirical results

Table 4 presents the summary statistics for the main variables in the regression analysis(including the variables used in the next section).Table 5 reports the regression results for the simultaneous Eqs.(1a)and(1b); Part I uses Au irrp as the independent variable in Model(1a),and Part II uses Auirru.As the table shows,the detection effort(Auirrp and Auirru)of audit institutions is significantly positively related to the degree of bureaucratic corruption(Corrupt)at the provincial level,which is consistent with Hypothesis 1.Meanwhile, the adoption rate of audit reports and newsletters and the amount of funds audited both exert a significantpositive influence on audit detection,which is consistent with our analysis in Section 3.Market development and openness are negatively related to irregularities found in government auditing.This is understandable because provinces that are more open and have good market development tend to have more transparent government and less misbehavior among bureaucrats.The regression results for the corruption equation indicate that the degree of corruption in year t is positively related to irregularities detected in year t-1.There are several explanations.First,the audit results of local audit institutions,especially at the municipal and county levels,are not always disclosed to the general public(Song et al.,2009).Meanwhile,audit decisions—including suggestions for sanctions,penalties and rectification—are always against the audited bodies rather than individuals and these decisions are seldom fulfilled,which considerably reduces the deterrent power of government auditing(Wei et al.,2010).Second,we use corruption cases filed by the procuratorial organs to measure the level of corruption,while audit institutions and procuratorial organs are cooperative in corruption investigations.More cases and clues may be transferred when auditors put more effort into detection,and these clues may be delayed to the lagged year and thus increase the number of corruption cases in the lagged year.Third, corruption is a chronic problem,thus if the audit institutions only report and disclose the misbehavior and relevant disposals within the government,it will not exert a strong deterrent effect,nor will it reduce corruption.

Table 5 also shows that the relative compensation of public officials and the level of openness are negatively related to corruption,which is also consistent with Wu and Rui(2010).However,the education variable is negatively related to corruption,which is against our expectation.As there may be strong correlations among the dependent variables,we regress corrupt on education separately,but still find that they are positively related.Two implications may be inferred from this finding.First,we need to improve the measurement of education,because although the flow of human resources across provinces in China is very common,the education measure is calculated from household registration data.Second,as shown in Table 4,the average education level in China is only 7.92 years and there is little variation in the sample,thus the incremental need for transparency caused by education may not prevail at present.

Table 4Descriptive statistics.

6.Post-audit rectification and corruption

6.1.Correlations

The exposure of misbehavior detected in government auditing is not enough for audit institutions to play a role in curbing corruption.The implementation of audit decisions and rectifications following audits are moreimportant.If violations and misbehavior are not punished accordingly,the audit decisions will be worthless.It is only by punishing violations and rectifying wrongdoings that government audits can deter malfeasant officials.Audit institutions are involved in the rectification process in several ways.First,once violations and misbehavior are found,the audit institution must either take measures to deal with them directly,or transfer severe cases to the people’s government and departments in charge and provide disposal suggestions.The audit institution should also provide suggestions on how to improve and standardize the internal control and financial management of the auditee.Finally,the audit institution should perform checks on the implementation of all sanctions and penalties and the outcome of transferred cases and clues,and urge the audited bodies to complete all of the treatment decisions and rectification suggestions when they are reluctant to do so. However,as indicated in the previous analysis,the registration rate of cases and clues transferred by audit institutions is quite low,thus the implementation of sanctions and penalties imposed directly by the audit institutions may be the key to guaranteeing the power of the government audit system.Therefore,we use the implementation of sanctions and penalties to measure rectification effort,and examine its influence on corruption.

The scatter plot in Fig.5 describes the relationship between the degree of corruption in year t(Corrupti,t) and the rectification results after an audit in year t-1(Au reci,t-1).Fig.5a applies the rectification amount percapita(Au recpi,t-1)and Fig.5b applies the recti fication amount per audited unit(Au recui,t-1).From the figure,a primary negative correlation between audit recti fication effort and the degree of corruption in the lagged year can be inferred.

Table 5Irregularities detected in government auditing and corruption.

6.2.Multivariate models

According to previous analysis,on the one hand,rectification is the implementation of sanctions,penalties and suggestions imposed by audit institutions.Only when all sanctions,penalties and suggestions are carried out can economic and financial order be maintained and the deterrent effect of government auditing guaranteed.On the other hand,the rectification process needs the support of leading local government officials and the cooperation of related parties in addition to the effort of the audit institution.Therefore,the more thoroughly the audit sanctions and penalties are implemented,the better the rectification results will be,and the audited bodies that are punished will be less likely to commit misbehavior in the future.At the same time,the prevailing corruption may also hinder rectification effort.That is,rectification may be even more difficult to enforce in more corrupt places.To capture the two-way relationship between audit rectification and corruption,the following simultaneous equation models are empirically tested.

Fig.5.Correlation between audit rectification effort and the degree of local corruption(1999-2008).

Model(2a)examines how audit recti fication effort in year t-1(Aureci,t-1)affect the degree of bureaucrats’corruption in year t(Corrupti,t).Model(2b)tests whether corruption in year t(Corrupti,t)influences the audit recti fication process in the same period(Aureci,t).Similar to the measurement of audit detection effort,we use the amount of recti fication per capita(Au recp)and per unit(Aurecu)to proxy for audit recti fication effort. The variable de finitions are presented in Table 3 and descriptive statistics are in Table 4.The regression results are reported in Table 6.

6.3.Empirical results

Table 6 reports the regression results for Models(2a)and(2b);Part I uses recti fication per capita(Au recp) as the measure of recti fication effort,whereas Part II uses recti fication per units(Au recu).As shown in thetable,the coefficients of Au recpi,t-1and Aurecui,t-1are both significantly negative,indicating that after controlling for other factors,the more effort put into recti fication at present,the less corruption there will be in the following period,which is consistent with our Hypothesis 2.Meanwhile,concerning the reverse influence of corruption on audit recti fication,the regression results of Model(2b)also show that more corrupt places tend to have worse rectification results(the coefficients of Corrupt are significantly negative in both Column 4 and Column 6).In addition,the coefficients of Wage,Govsize,Open,Market Rptcyl,Deficit and Auditor are all consistent with our predictions.Provinces that have higher relative compensation for public officials,have smaller local governments,are more open in international trade and have better market development tend to be less corrupt.Better rectification results are also achieved in provinces with better financial status(higher revenue and low deficit)and when audit reports and other audit information are valued by leading government officials,the audited departments and other related parties.

Table 6Post-audit rectification and corruption.

6.4.Further analysis

We have examined the relationships between audit detection effort and corruption and between audit rectification and corruption separately.Through these tests and analysis we have learnt two things:first,the detection effort of government auditing is positively related to the degree of corruption—that is,local audit institutions tend to find more irregularities in more corrupt places;and second,the degree of corruption is negatively related to audit rectification effort in the previous period—that is,thorough rectification after an audit can help to reduce corruption.To capture the interactions between the three factors—audit detection effort,audit rectification and corruption—we construct the following simultaneous equation models.

Table 7Regression results of simultaneous equations for detection of irregularities,rectification and corruption.

Model(3a)is exactly the same as Model(1a).Model(3b)is based on Model(1b)but adds Aurecpi,t-1as another determinant of Corrupti,t,asitwas significantin Table6.Model(3c)isthe same as Model(2b).The variables are de fined in Table 3 and descriptive statistics are in Table 4.The regression results are stated in Table 7.

As shown in Table 7,the coefficient of Auirrpi,t-1in Model(3a)remains significantly positive and the coefif cient of Aurecpi,t-1remains significantly negative,which are consistent with previous findings.These results again demonstrate that local audit institutions are diligent in detecting irregularities,thus more irregularities tend to be found in more corrupt places.Furthermore,recti fication effort after an audit can strengthen the effectiveness of government auditing and help to reduce corruption in the future.

7.Conclusion

This paper investigates the role that government auditing plays in the fight against corruption.Using a sample of provincial data from China from 1999 to 2008,we construct simultaneous equation models to examine the interactions among audit detection,audit rectification and bureaucratic corruption at the local level.Our research indicates that local audit institutions can detect misbehavior and violations in public financial revenues and expenditures and make corresponding decisions to rectify these problems.However,not all sanctions,penalties and suggestions proposed by audit institutions are fulfilled.The empirical results also indicate that rectification effort after an audit can strengthen the effectiveness of government auditing.That is,the level of corruption can be reduced more effectively in places where rectification activities are carried out more thoroughly.

This paper also provides some far-reaching implications for China’s government auditing practices and corruption control initiatives.Our research indicates that rectification after an audit is even more important than the fraud detection process itself.Whereas the discovery of irregularities without subsequent disposals cannot make government auditing a powerful accountability regime,rectification that includes“asking for responsibility”is effective in reducing corruption.Therefore,leading government officials,audit institutions and other professional supervisory agencies should place greater emphasis on the rectification process after audits.They should ensure not only that all lawful sanctions and penalties imposed by government auditors are exercised thoroughly,but also that institutional problems found in auditing are solved in a timely manner.It is only by correcting misbehavior found in government auditing and punishing all of the responsible departments and individuals for their wrongdoing,that government transparency can be achieved and the chronic corruption problem can be genuinely relieved.

There are two limitations of this study that must be acknowledged.First,auditors’independence,competence and the quality control of the auditing process may all affect an audit institution’s performance,but due to data availability we did not include these factors in our regression.Second,although the deterrent effect of government auditing may arise from several aspects,such as the public exposure of irregularities and responsible officers,lawful punishment of severe economic crimes,political demotion and other administrative punishments,we focus only on the implementation of sanctions and penalties.Thus,our results should be interpreted with caution.However,the limitations of this paper can also be overcome as China’s government auditing practices are further standardized and perfected and more data becomes available.Therefore,this paper also leaves much room for future research.

Acknowledgements

This paper is the result of research supported by China’s National Natural Science Foundation(70972076), the Humanities and Social Science Foundation of Ministry of Education(09YJA790199),and the Key Re-search Institutions of Humanities and Social Science Foundation of Guangdong Province(11JDXM79004). We would like to thank Dr.Liandong Zhang,Prof.Xiajia Su,Xiaohui Qu,Minghai Wei,Feng Liu,Dr. Danglun Luo and other workshop participants at the 2011 CJAR Symposium for their insightful comments, among which,Dr.Liandong Zhang’s suggestions are especially constructive for the improvement of this paper.We are grateful to the helpful advice from PhD candidates Linjian Wang,Wei Shu,Meihua Zhou,Dongjie Lin and Chunli Liu at Sun Yat-Sen University.We would like to give special thanks to the anonymous referees and editors.However,we are completely responsible for the content of this paper.

Adit,T.S.,2003.Economic analysis of corruption:a survey.The Economic Journal 113(491),632-655.

Ali,A.M.,Isse,H.S.,2003.Determinants of economic corruption:a cross-country comparison.Canto Journal 22(3),449-466.

Blume,L.,Voigt,S.,2011.Does organizational design of supreme audit institutions matter?A cross-country assessment.European Journal of Political Economy 27,15-229.

Chen,G.,Li,S.,2010.Corruption,income distribution and income gap in China.Economic Science 2,55-68(in Chinese).

Cheng,B.K.,Sun,X.T.,2006.Market reform reduce corruption:the experience of Chile’s reform and its inspiration for China.Journal of Beijing Administrative College 6,23-26.

DeAngelo,L.E.,1981.Auditor size and audit quality.Journal of Accounting and Economics 3,183-199.

Di Tella,R.,Schargrodsky,E.,2003.The role of wages and auditing during a crackdown on corruption in the city of Buenos Aires. Journal of Law and Economics 46(1),269-292.

Dye,K.M.,Stapenhurst,R.,1998.Pillars of Integrity:The Importance of Supreme Audit Institutions in Curbing Corruption.The World Bank.

Feng,J.K.,2005.Research on national audit system directed by Accountable government.Auditing Research 6,13-18(in Chinese).

Ferraz,C.,Finan,F.,2008.Exposing corrupt politicians:the effect of Brazil’s publicly released audits on electoral outcomes.Quarterly Journal of Economics 123(2),703-745.

Ferraz,C.,Finan,F.,2011.Electoral accountability and corruption:evidence from the audits of local government.American Economic Review 101(4),1274-1311.

Fisman,R.,Gatti,R.,2002.Decentralization and corruption:evidence across countries.Journal of Public Economics 83,325-345.

Gatti,R.,2004.Explaining corruption:are open countries less corrupt?Journal of International Development 16,851-861.

Glaeser,E.L.,Saks,R.E.,2006.Corruption in America.Journal of Public Economics 90,1053-1072.

Gong,T.,2009.Audit for accountability in China:an incomplete mission.The Australian Journal of Public Administration 68(1),5-16.

Gong,T.,2010.Auditing,accountability,and corruption in China:prospects and problems.Journal of Public Administration 2,69-84(in Chinese).

Hu,Z.Y.,2005.Promoting the state audit system to curb corruption and rent-seeking.Economy&Audit Study 1,18-22(in Chinese).

Hu,A.G.,Guo,Y.,2001.The comprehensive strategies and institutional design for curbing corruption in the transitional period. Management World 6,44-55(in Chinese).

Huang,R.B.,Wang,Y.T.,2010.The empirical study on provincial government audit quality(2002-2006).Accounting Research 6,70-76 (in Chinese).

Klitgaard,R.,1998.International cooperation against corruption.Finance and Development 35(1),3-6.

Lef f,N.,1964.Economic development through bureaucratic corruption.American Behavioral Scientist 8(3),8-14.

Li,C.Y.,Zhuang,D.S.,2009.A new look at financial corruption.Decision 12,34-35.

Li,J.T.,Miao,L.Q.,Liang,Y.H.,2011.An empirical study on operating effects of accountability audit.Auditing Research 3,24-30(in Chinese).

Ma,S.G.,2007.Empirical research on the effect of government auditors’qualities on audit performance.Auditing Research 3,24-29(in Chinese).

Mauro,P.,1998.Corruption and the composition of government expenditure.Journal of Public Economics 69(2),263-279.

Melo,M.A.,Pereira,C.,Figueiredo,C.M.,2009.Political and institutional checks on corruption—explaining the performance of Brazilian audit institutions.Comparative Political Studies 42(9),1217-1244.

Olken,B.A.,2007.Monitoring corruption:evidence from a field experiment in Indonesia.Journal of Political Economy 115(2),200-249.

Pereira,C.,Melo,M.A.,Figueiredo,C.M.,2009.The corruption-enhancing role of re-election incentives:counter-intuitive evidence from Brazil’s audit reports.Political Research Quarterly 62(4),731-744.

Raman,K.K.,Wilson,E.R.,1994.Governmental audit procurement practices and seasoned bond prices.The Accounting Review 69(4), 517-538.

Reinikka,R.,Svensson,J.,2005.Fighting corruption to improve schooling:evidence from a newspaper Campaign in Uganda.Journal of the European Economic Association 3(2-3),1-9.

Saito,Y.,Mcintosh,C.S.,2010.The economic value of auditing and its effectiveness in public school operations.Contemporary Accounting Research 27(2),639-667.

Schelker,M.,Eichenberger,R.,2010.Auditors and fiscal policy:empirical evidence on a little big institution.Journal of Comparative Economics 38,357-380.

Shleifer,A.,Vishny,R.W.,1993.Corruption.Quarterly Journal of Economics 108(3),599-617.

Song,C.,Zhou,C.X.,Huang,L.,2009.A study of the audit results announcement of the local auditing organs in China.Contemporary Finance&Economics 9,121-126(in Chinese).

Sun,G.,Lu,M.,Zhang,J.P.,2005.Anti-corruption,market construction and economic growth.China Economic Quarterly 4(10),1-22.

Svensson,J.,2005.Eight questions about corruption.Journal of Economic Perspectives 19(3),19-42.

Wei,D.H.,Qin,Z.Y.,Tang,S.Q.,2010.Research on the relation between the efficiency of government audit and the security offinancial fund:some evidence from the data of national audit yearbook.Auditing Research 3,9-14(in Chinese).

Wu,Y.P.,2010.Government size,government quality and economic performance.China’s experience.Social Science Front 3,36-46(in Chinese).

Wu,Y.P.,Rui,M.,2010.Regional corruption,marketization and economic growth in China.Management World 11,10-17(in Chinese).

Wu,J.P.,Yao,L.F.,2008.Corruption and the departure in the composition of public expenditure.China Soft Science 5,8-14(in Chinese).

Yang,C.M.,Zhao,F.J.,2004.The macroeconomic analysis of administrative corruption.Economic Research Journal 9,101-109 (in Chinese).

Zhao,J.S.,2005.An analytical framework for government audit quality characteristics in China.Auditing Research 4,65-68(in Chinese).

Zheng,S.Q.,Yin,P.,2010.Position of auditing office,auditing compromise and efficiency of auditing decisions.Auditing Research 6,53-58(in Chinese).

Zhou,L.A.,Tao,J.,2009.Government size,market development and corruption.Economic Research Journal 1,58-69(in Chinese).

1 October 2011

*Corresponding author.Tel.:+86 13632439317.

E-mail addresses:fliujin@126.com(J.Liu),mnslb@126.com(B.Lin).

Government auditing

Post-audit rectification

Corruption control

China Journal of Accounting Research2012年2期

China Journal of Accounting Research2012年2期

- China Journal of Accounting Research的其它文章

- The reform of accounting standards and audit pricing

- State control,access to capital and firm performance

- Board independence,internal information environment and voluntary disclosure of auditors’reports on internal controls

- Relative performance evaluation and executive compensation: Evidence from Chinese listed companies