Predicting Carpark Prices Indices in Hong Kong Using AutoML

Rita Yi Man Li,Lingxi Song,Bo Li,3,M.James C.Crabbe and Xiao-Guang Yue

1Sustainable Real Estate Research Center,Hong Kong Shue Yan University,Hong Kong,999077,China

2Chakrabongse Bhuvanarth International Institute for Interdisciplinary Studies,Rajamangala University of Technology Tawan-Ok,Bangkok,10400,Thailand

3Zhongyuan Region Company,Jinke Property Group Co.,Ltd.,Zhengzhou,450000,China

4Wolfson College,Oxford University,Oxford,OX2 6UD,UK

5Institute of Biomedical and Environmental Science&Technology,University of Bedfordshire,Luton,LU1 3JU,UK

6School of Life Sciences,Shanxi University,Taiyuan,030006,China

7Department of Computer Science and Engineering,European University Cyprus,Nicosia,1516,Cyprus

ABSTRACT The aims of this study were threefold:1)study the research gap in carpark and price index via big data and natural language processing,2) examine the research gap of carpark indices,and 3) construct carpark price indices via repeat sales methods and predict carpark indices via the AutoML.By researching the keyword“carpark”in Google Scholar,the largest electronic academic database that covers Web of Science and Scopus indexed articles,this study obtained 999 articles and book chapters from 1910 to 2019.It confirmed that most carpark research threw light on multi-storey carparks,management and ventilation systems,and reinforced concrete carparks.The most common research method was case studies.Regarding price index research,many previous studies focused on consumer,stock,press and futures,with many keywords being related to finance and economics.These indicated that there is no research predicting carpark price indices based on an AutoML approach.This study constructed repeat sales indices for 18 districts in Hong Kong by using 34,562 carpark transaction records from December 2009 to June 2019.Wanchai’s carpark price was about four times that of Yuen Long’s carpark price,indicating the considerable carpark price differences in Hong Kong.This research evidenced the features that affected the carpark price indices models most:gold price ranked the first in all 19 models;oil price or Link stock price ranked second depending on the district,and carpark affordability ranked third.

KEYWORDS Carpark;repeat sales index;AutoML;Hong Kong;natural language processing;tokenization

1 Introduction

Parking a car is routine for many drivers [1].Many modern cities have limited carparks despite increasing the number of vehicles[2,3].Some US cities have implemented a clear policy to manage offstreet parking[4].The demand has led to a sharp rise in car parking fees.Previous research[5–8]showed that parking costs in the city,transit time via public transport,and transport times at the station were essential factors that affected driving behaviour.Indeed,in response to the high demand for parking,the Victorian State Government provided 5,000 additional parking spaces at railway stations within the regional and metropolitan rail networks in 2006[9].In Hong Kong,many carparks locate beneath towers of residential buildings to meet residents’needs[10].

As carpark availability impacts drivers’time,some research investigated carpark management systems.It mainly includes parking management,user management,spatial allocation,and route distribution.An automatic parking lot allocation mechanism was developed to ease the parking process.The user management module provides users with registration information to address individual parking needs [11],which is the basis for automatic parking allocation.The automatic parking lot distribution mechanism,based on WiFi positioning technology [12],considers the individual needs of the parking user in the allocation of parking spaces and the route distribution module,thereby overcoming the problem of finding a parking lot and easing traffic congestion.

Some users have raised concerns regarding mobile apps that provide real-time parking information.Automatically assigned carparks via algorithms could alleviate parking problems [13].System insecurity and privacy leakage that protect personal data were found to have room for improvement.Moreover,a digital divide exists among disadvantaged groups,and the mere provision of Information and Communication Technology(ICT)facilities cannot solve the problem.It is developing a suitable way for ICTs that serves all citizens matters[14].Overall,technologies alone cannot make a city smart or more intelligent.

Another strand of carpark research mainly sheds light on environmental and sustainability issues.Liquid fuel combustion in vehicles’engines is the primary source of the emission of benzene,toluene,ethylbenzene,and xylene(BTEX)compounds into the air in the underground car park.Marć et al.[15]concluded that benzene concentration is considerably higher in an underground carpark than in an above-ground carpark.It was found that air quality in a car park is affected by the number of cars parking on the lower carpark level and the closest location of the exit/entrance of the car park.

Zhang et al.[16] threw light on electric vehicles;matching the vehicles and carpark locations do concern renting price and time fit and how vehicles in the shared carparks may take part in the electricity market according to the behaviour of typical electric vehicles (EVs).Furthermore,a shared carpark system for multiple parking units in a power market can integrate multiple carpark units.Each unit contains its position scenarios,power price,and independent power consumption.To address the competition between units,a renting bids sequencing table could integrate the rental price and the benefit that contribute to the units.A nesting optimization model was also built for benefit contribution computation.To process the nesting optimization model,a modified Lagrangian multiplier method was developed to establish an optimization model to solve various competing concerns like rental price and power by a gradient-based algorithm.

In Hong Kong,carparks may be restricted to residents’use,or they could be opened to the public.90%of the open space carpark is for the public.There are approximately 690,000 carparks in Hong Kong,195,000 designated for public use and 495,000 for private use in commercial,residential,and industrial buildings [17].According to the Estate Agents Authority [18],carpark conveyancing involves(1)provisional agreement for sale and purchase,(2)formal agreement for sale and purchase,(3)redemption,(4)assignment,(5)mortgage,(6)stamp duty,(7)land registration,(8)completion,(9)title,(10)sub-sale and sub-purchase.

The Rating and Valuation Department first introduced computer-assisted mass appraisal(CAMA) techniques for assessing rates mid-1980s.CAMA has since been extensively applied to systematically enable the valuation staff to assess large numbers of properties within a short time frame and produce more accurate and consistent valuations [19].While there are indices for most property types such as residential,industrial and offices,the Rating and Valuation Department in Hong Kong and academia have not yet constructed carpark price indices.Furthermore,predicting carpark price indices via AutoML will be of great practical value,allowing officials to forecast future prices better and provide valuable information to town planners.

2 Methods,Results and Discussion

2.1 Google Scholar Results from 1910 to 2019

This study reviewed carpark and price index research indexed in Google Scholar.Previous research found that Google contained the most academic articles for each topic [20].Google Scholar had the most significant percentage of citations in all fields of research (93%–96%),substantially more than Web of Science(WoS)(27%–73%)and Scopus(35%–77%)[21].It then utilized the tokenization method to parse the titles of the publications indexed on Google Scholar to identify the research void[22].

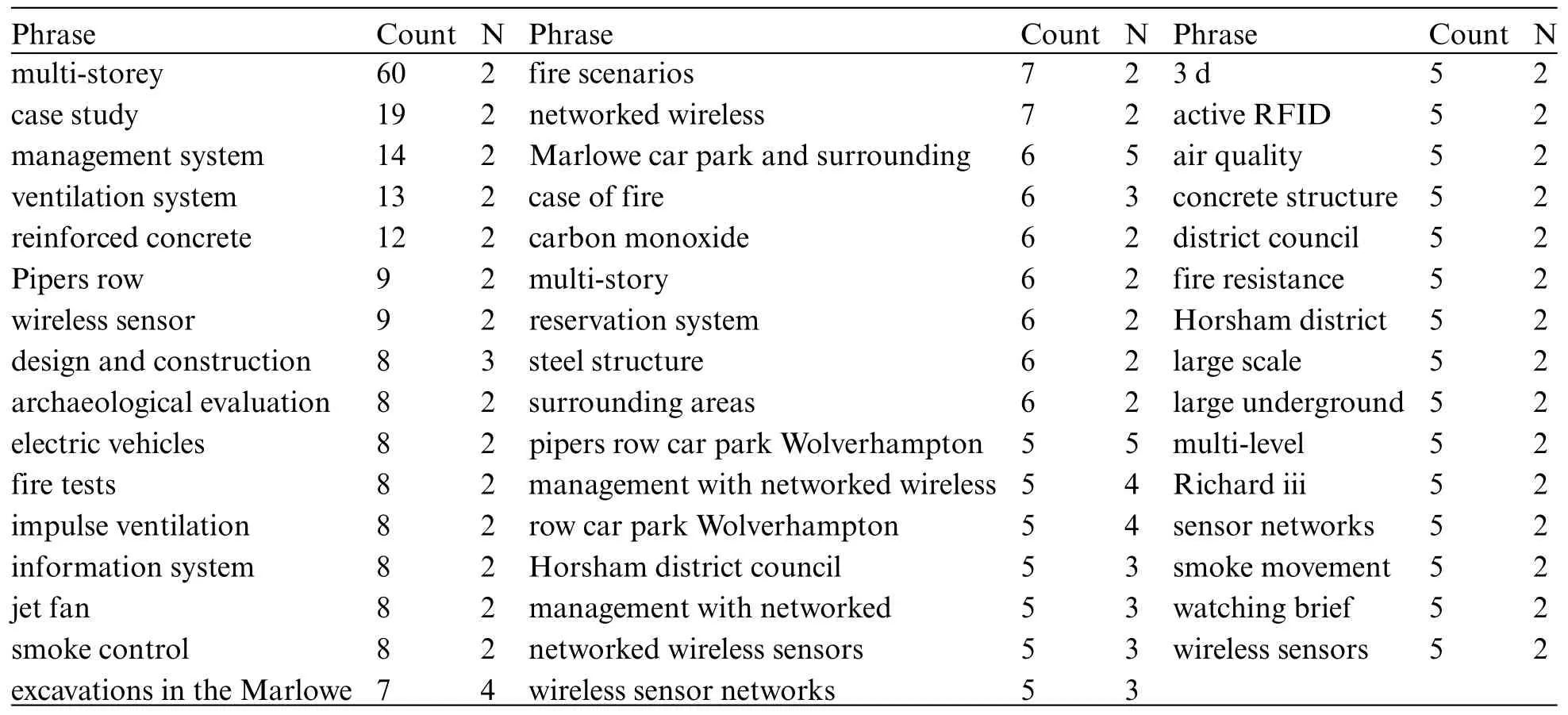

Google Scholar may include articles outside the authoritative databases such as WoS and Scopus,comprehensive coverage can reveal articles related to carparks,including those indexed in these databases and outside this topic [23].Using carpark as the keyword search in Google Scholar,this study obtained 999 results from 1910 to 2019 with carpark in the title.It allowed us to find the latest research about carpark quickly and confirmed carpark price index prediction as to the research gap.1When we used“carpark price”as the keyword,there were two results only which did not indicate research on carpark price prediction.In contrast,there were 999 results of carpark price(the quotation marks were removed),which consisted of far more irrelevant results due to different types of asset prices.The results showed that the most used words in the title associated with carpark research include“underground”,“system”,“fire”,“multi”,and “design” (Fig.1).The results of tokenization,one branch of natural language processing,showed that many of these studies focused on multi-storey management and ventilation systems,multi-storey,and reinforced concrete case studies(Table 1).All these factors indicated that popular studies of carparks were related to the built environment.There was no carpark research with“index”in the title.The most relevant cited articles are“An intelligent car park management system based on wireless sensor networks”,“Underground carpark at the House of Commons,London:geotechnical aspects”,and“Influence of bus-based park and ride facilities on users’car traffic”(Table 2).However,one notable characteristic of carpark research is that many of these are conference articles rather than peer-reviewed journal articles.

Figure 1:Major words used in carpark research titles for research work indexed in Scholar Google results from 1910 to 2019

Table 1:Articles published 1910–2019 indexed in Scholar Google with the most significant number of citations

Table 2:The top 12 articles published from 1910 to 2019 indexed in Scholar Google with the largest number of citations

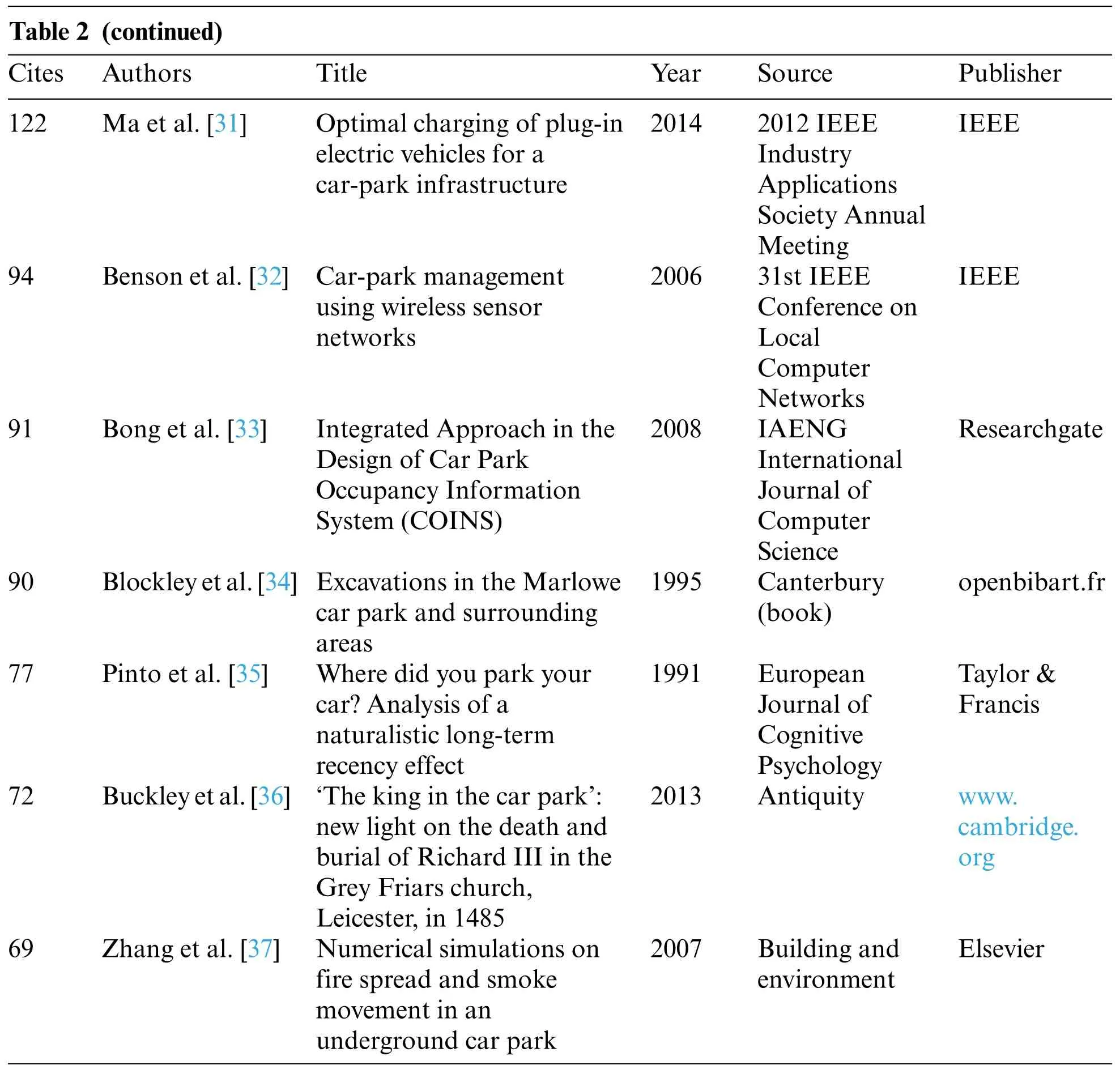

Table 2 (continued)Cites Authors Title Year Source Publisher 122 Ma et al.[31] Optimal charging of plug-in electric vehicles for a car-park infrastructure 2014 2012 IEEE Industry Applications Society Annual Meeting IEEE 94 Benson et al.[32] Car-park management using wireless sensor networks 2006 31st IEEE Conference on Local Computer Networks IEEE 91 Bong et al.[33] Integrated Approach in the Design of Car Park Occupancy Information System(COINS)2008 IAENG International Journal of Computer Science Researchgate 90 Blockley et al.[34] Excavations in the Marlowe car park and surrounding areas 1995 Canterbury(book)openbibart.fr 77 Pinto et al.[35] Where did you park your car?Analysis of a naturalistic long-term recency effect 1991 European Journal of Cognitive Psychology Taylor&Francis 72 Buckley et al.[36] ‘The king in the car park’:new light on the death and burial of Richard III in the Grey Friars church,Leicester,in 1485 2013 Antiquity www.cambridge.org 69 Zhang et al.[37] Numerical simulations on fire spread and smoke movement in an underground car park 2007 Building and environment Elsevier

2.2 Price Index:Scholar Google Results from 1988 to 2019

To quantify and compare price movements,different indices were developed.For example,the Hang Seng Index is used to measure the movement of a basket of stock prices in Hong Kong,and the World Development Index is used to compare the different levels of development Worldwide.Likewise,there are many different ways to construct indices in academia[24].

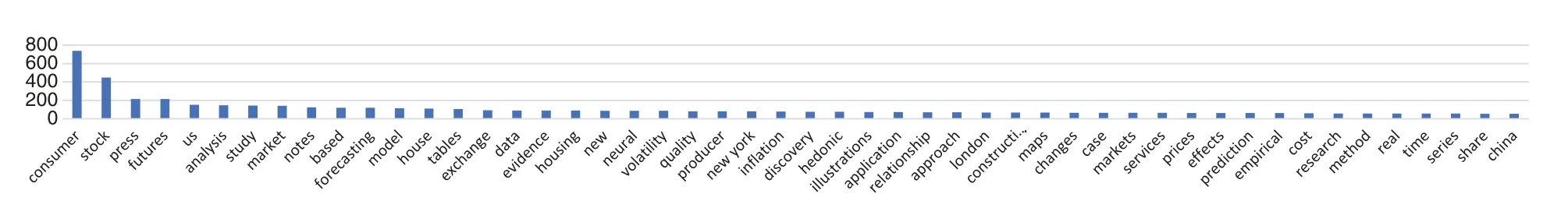

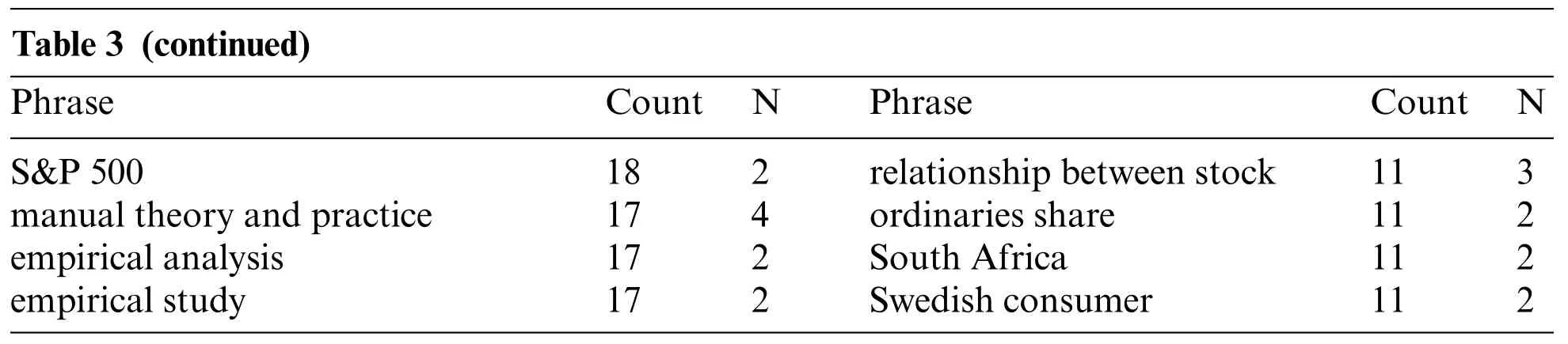

There were 2982 articles in Google Scholar search results.Popular article titles were associated with consumer,stock,press and futures (Fig.2).Thus,many of these title keywords were related to finance and economics.The study of natural language has been an area of research interest for years,and tokenization is one of the methods that has been adopted[22,25].However,this method is rarely used in real estate research.This study obtained the highest frequency of phrases by utilizing a tokenization approach,a natural language processing method.These included“New York”,“stock index futures”,“neural network”,and“US consumer”(Table 3).

Figure 2:Major words used in price index research titles for research work indexed in Scholar Google results from 1988 to 2019

Table 3:Key phrases

Table 3 (continued)Phrase Count N Phrase Count N S&P 500 18 2 relationship between stock 11 3 manual theory and practice 17 4 ordinaries share 11 2 empirical analysis 17 2 South Africa 11 2 empirical study 17 2 Swedish consumer 11 2

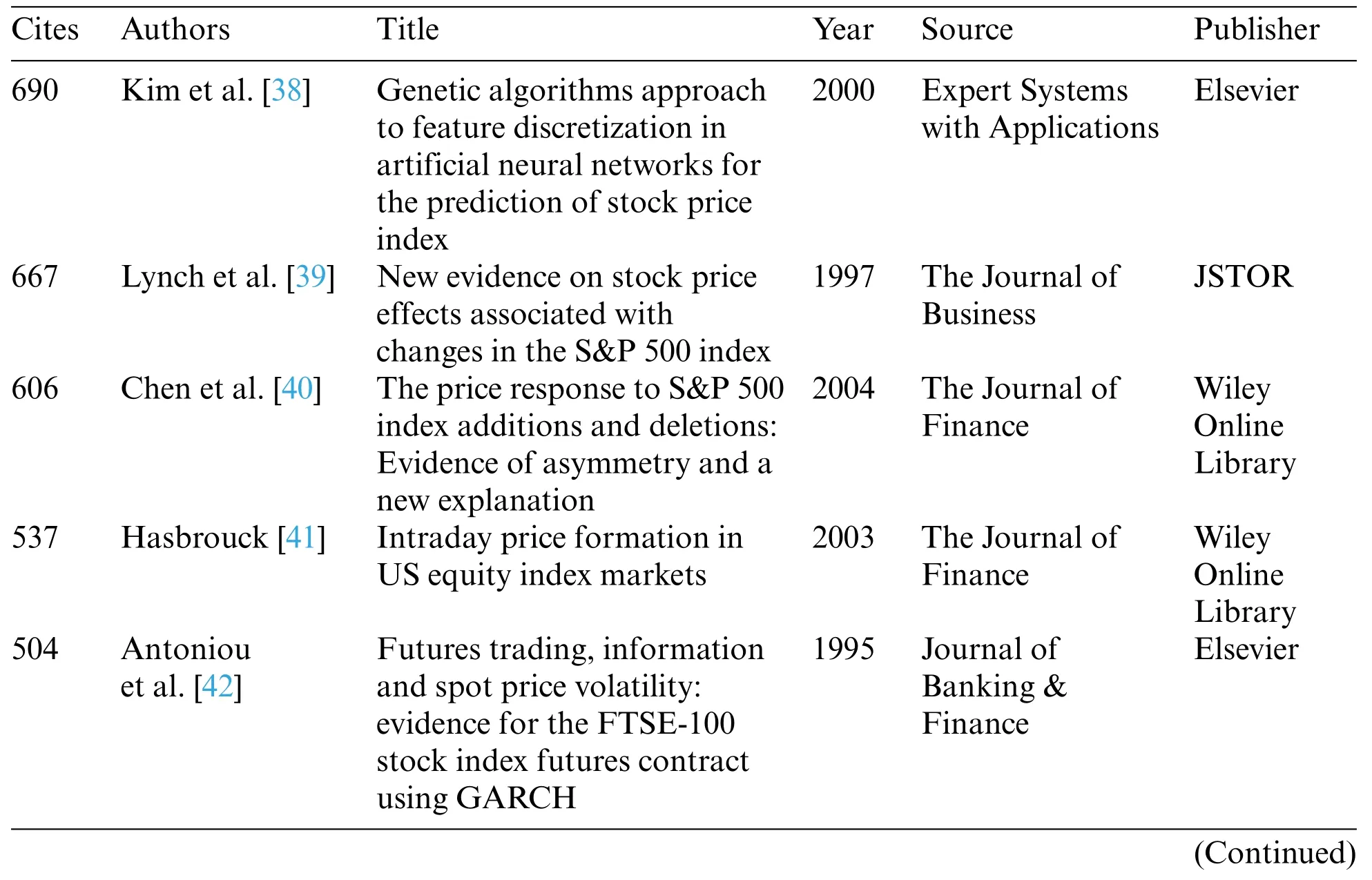

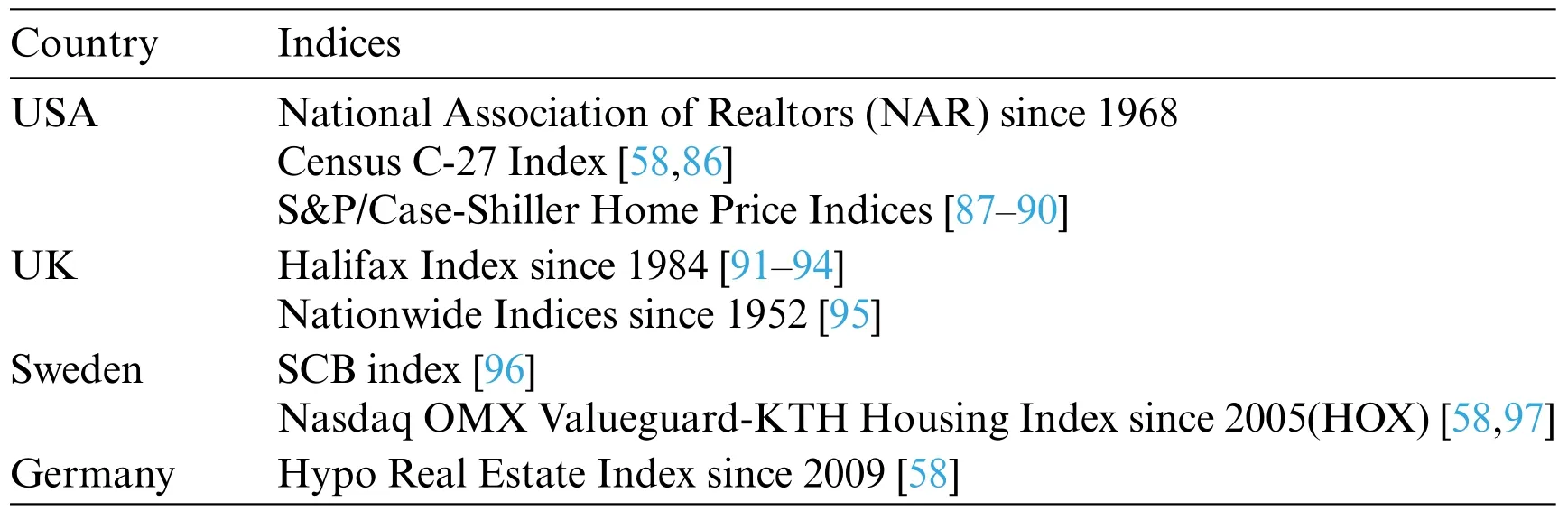

Besides,this study also threw light on these articles’citations,that is,articles cited and referenced by other research.Although criticisms exist regarding the use of citations to measure the impact of the research,it remains one easy way to obtain a rough idea of the usefulness of the research within the academic circle.This study found that the highest cited articles included “Genetic algorithms approach to feature discretization in artificial neural networks for the prediction of stock price index”(690 citations),“New evidence on stock price effects associated with changes in the S&P 500 index”(667 citations) and “The price response to S&P 500 index additions and deletions: Evidence of asymmetry and a new explanation”(Table 4).While there are articles related to real estate and housing indices,none focused on the carpark price index.This study constructed a carpark index to fill the research void.

Table 4:Articles with the highest number of citations

Table 4 (continued)Cites Authors Title Year Source Publisher 498 Boskin et al.[43] Consumer prices,the consumer price index,and the cost of living 1998 Journal of Economic Perspectives aeaweb.org 476 Kara et al.[44] Predicting the direction of stock price index movement using artificial neural networks and support vector machines:The sample of the Istanbul Stock Exchange 2011 Expert Systems with Applications Elsevier 472 Choi et al.[45] Why does the law of one price fail?An experiment on index mutual funds 2009 The Review of Financial Studies Oxford 434 Can et al.[46]Spatial dependence and house price index construction 1997 The Journal of Real Estate Finance and Economics Springer 402 Wahab et al.[47] Price dynamics and error correction in stock index and stock index futures markets:A cointegration approach 1993 Journal of Futures Markets Wiley Online Library 379 Tse[48] Price discovery and volatility spillovers in the DJIA index and futures markets 1999 Journal of Futures Markets Wiley Online Library 360 Booth et al.[49] Price discovery in the German equity index derivatives markets 1999 Journal of Futures Markets Wiley Online Library

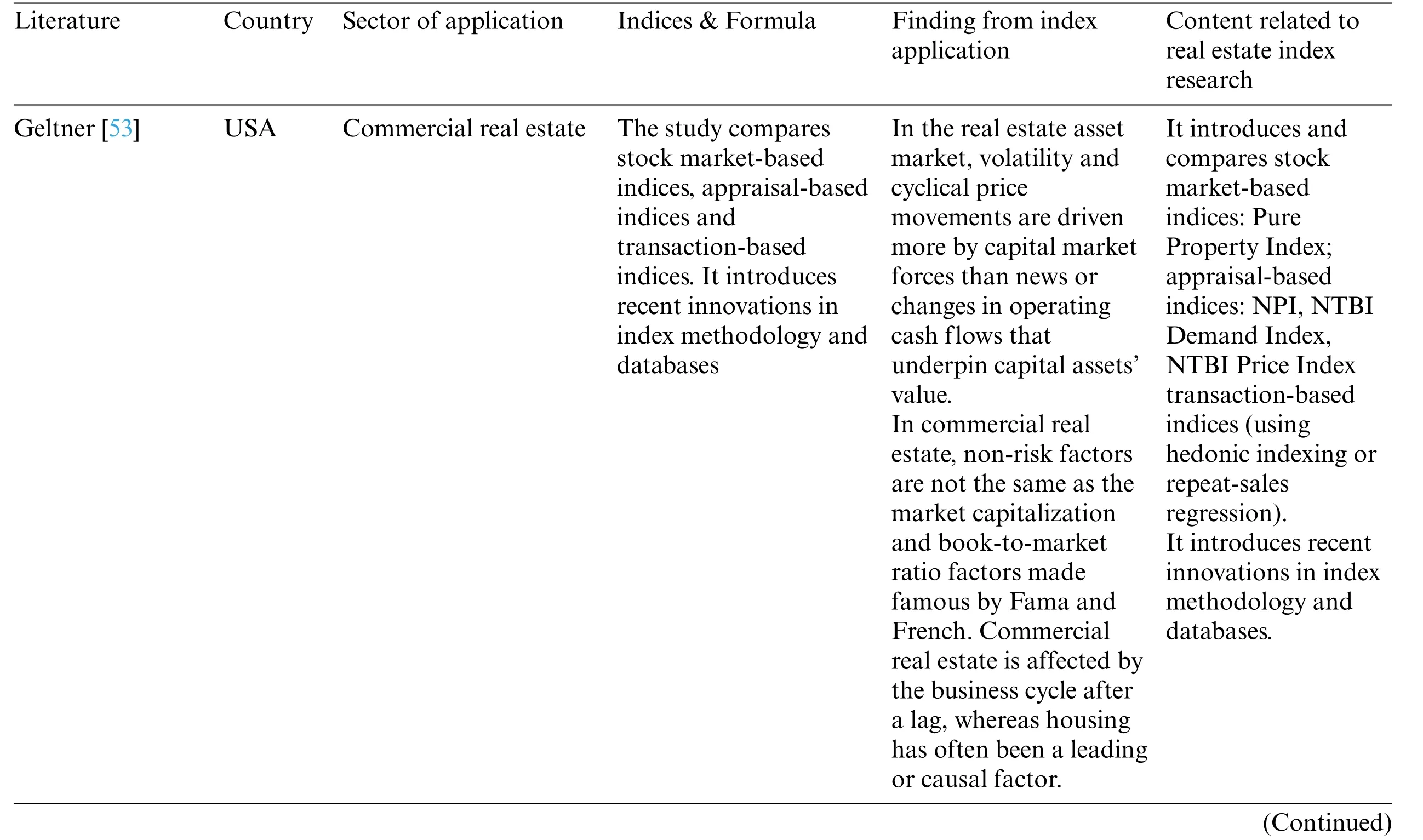

2.3 Previous Research on Real Estate Indices

This study presented detailed information in indices allows readers to track price changes over time[24]easily.Real estate price indices have been applied to test the efficiency of the housing market[50],understand the role of housing in a mixed-asset portfolio[51],examine the hedging mechanism for commercial real estate assets [42–54],estimate real estate derivatives and home equity insurance[55],the relationship between house price and housing demand[56],and model the supply of housing[57,58].

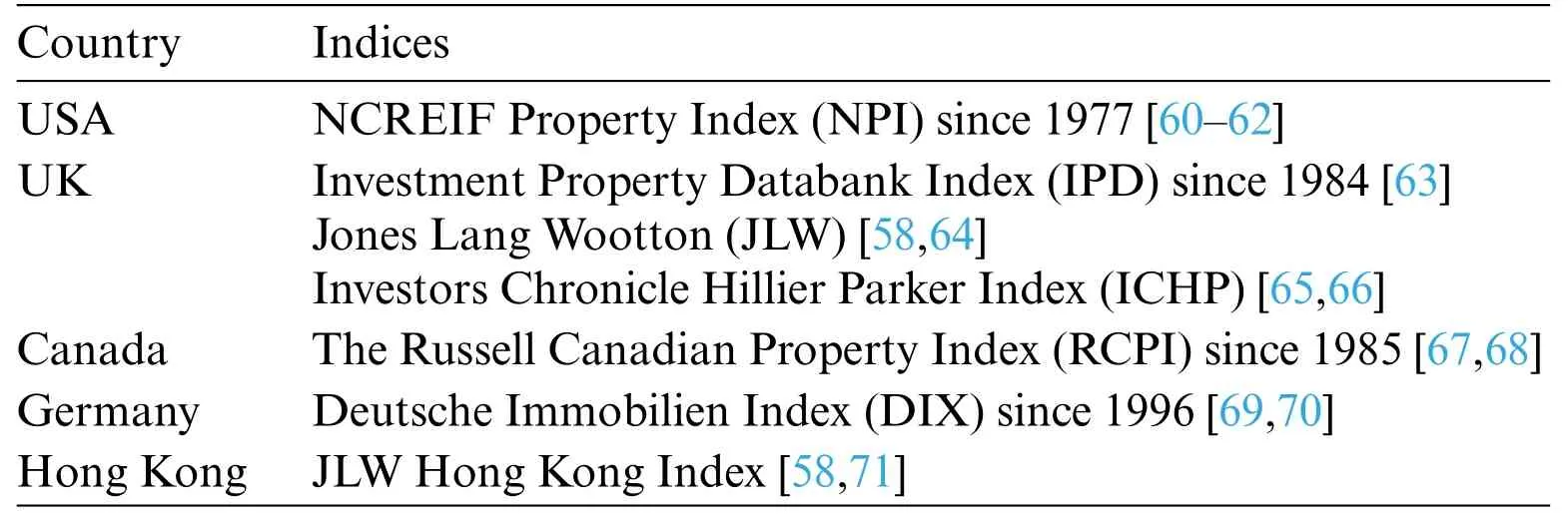

There is no consensus on the best method for constructing real estate indices [58].Real estate indices can generally be categorized into three groups: appraisal-based,stock market-based,and transaction-based[53].The appraisal-based indices are used for commercial properties,as the amount of information available on transaction prices in the commercial property market is insufficient.Appraisal data is also primarily used in an emerging housing market,where property transactions are infrequent and are mainly completed in secret,meaning that transaction databases rarely exist[58,59].The appraisal indices are constructed as an average of the current appraised values of the properties for each period in which the indices are reported.Thus,the appraisal-based indices rely on a sample of properties,and the appraisers have to ensure reliable results.However,the major drawback of this approach is that regular estimation of the property values requires a large amount of work.The following table presents some of the existing appraisal indices used around the world(Table 5).

Table 5:Global real estate indices

2.3.1 Indirect Real Estate Indices

Indirect real estate includes listed property stock [72] refers to shares of real estate companies listed on the stock exchanges [73].It also includes REITs,publicly listed real estate stocks,and real estate funds[74].There are many indirect real estate indices globally.For example,The S&P/ASX 300 Property Index included 24 A-REITs with office,retail and industrial sectors[75].

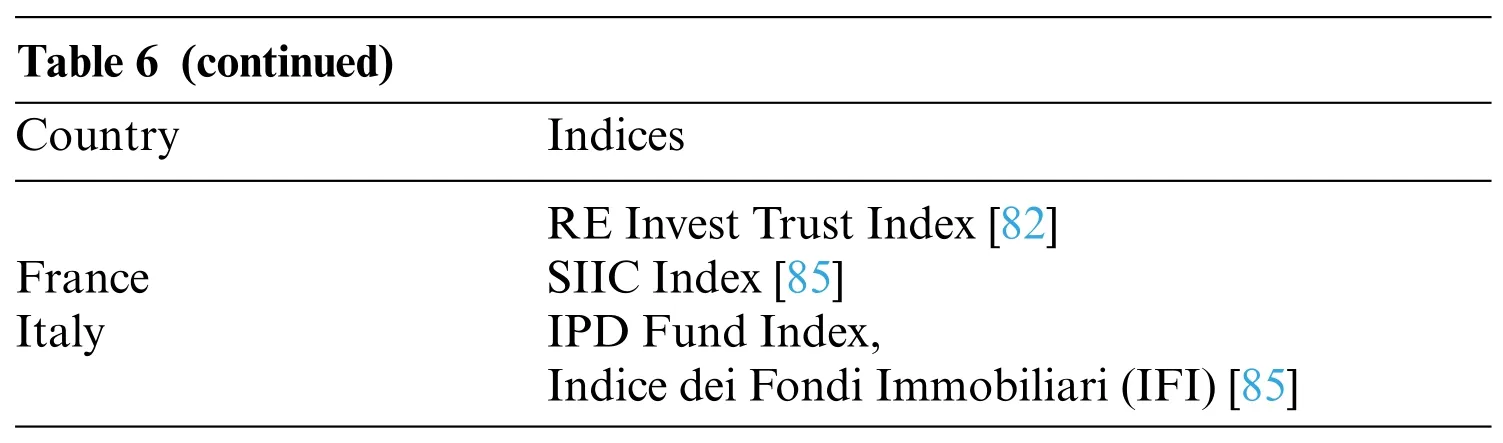

The most direct and fundamental source of information about property asset prices is transaction prices for individual assets.Derived from daily price changes of Real Estate Investment Trusts(REITs)prices in the stock market,the REITs index reflects the implied valuations of the underlying property assets held by the REITs[53].The real estate transaction price index,which attempts to control the heterogeneity issue,has recently become popular.It has primarily focused on single-family housing.Two major different approaches to control for heterogeneity have characterized the development of transaction price indices.The first is a hedonic index,and the other is repeat-sales regression [53].Table 6 identifies the existing transactional indices adopted by various countries[58].

Table 6:Global indirect real estate indices

Table 6 (continued)Country Indices RE Invest Trust Index[82]France SIIC Index[85]Italy IPD Fund Index,Indice dei Fondi Immobiliari(IFI)[85]

2.3.2 Methods for Constructing Indices

There are three main quality-controlled index construction approaches used for the transaction based index: the hedonic,repeat-sales and the hybrid,a combination of the first two approaches(Table 7)[53,58,98,99].The hedonic method constructs housing price indices using the time variable hedonic and cross-sectional hedonic models[58].In the hedonic model,property prices are regressed according to the property’s characteristics,which are applied on a period-by-period basis or estimated on pooled transaction data with time dummies as additional regressors[100].

Table 7:Selection of transactional indices

There are two basic variations of the repeat-sales method:the original repeat-sales(ORS)model and the weighted repeat-sales model[58].

The repeat-sales method standardizes properties’characteristics regarding the transacted properties by confining the analysis to properties sold at least twice[101].The repeat-sales method is a variant of the hedonic model.The only difference is that hedonic characteristics are excluded as they assume the properties’characteristics are the same in different periods.

The hybrid method utilizes the desirable features of hedonic and repeat-sales techniques to estimate real estate price indices[102].The idea for this model development is credited to Case et al.[103],with many improvements made since then.These include the Quigley (Q-hybrid) model,the Hill,Knight and Sirmans (HKS-hybrid) model,and the Englund,Quigley and Redfearn (EQR-hybrid)model[58].

Most regularly published indices have utilized the repeat sales method to construct indices.Silverstein [104] explained that the repeat sales index of housing price is an OLS (ordinary least square) panel regression of log house price over time fixed effects and house-specific fixed effects.Wang et al.[105] pointed out that the repeat sales model estimated a price index by regressing the price change of each item based on a set of dummy variables.The repeated sales method is relatively robust regarding specification error and omitted variables,more transparent,and easier for industry practitioners and the public to understand[58].Grimes et al.[106]suggested that the repeat-sales house price index had the advantage of simplicity in analyzing the price change.Clapp et al.[107]suggested that the repeat sales index could be better applied in real estate price estimation to control unchanged quality between sales.Therefore,this model has been applied to construct real estate indices.However,the repeat sales index also has disadvantages.For example,Wong et al.[108]indicated that the repeat sales model could not adjust for depreciation because age and time between sales exhibited a linear relationship.

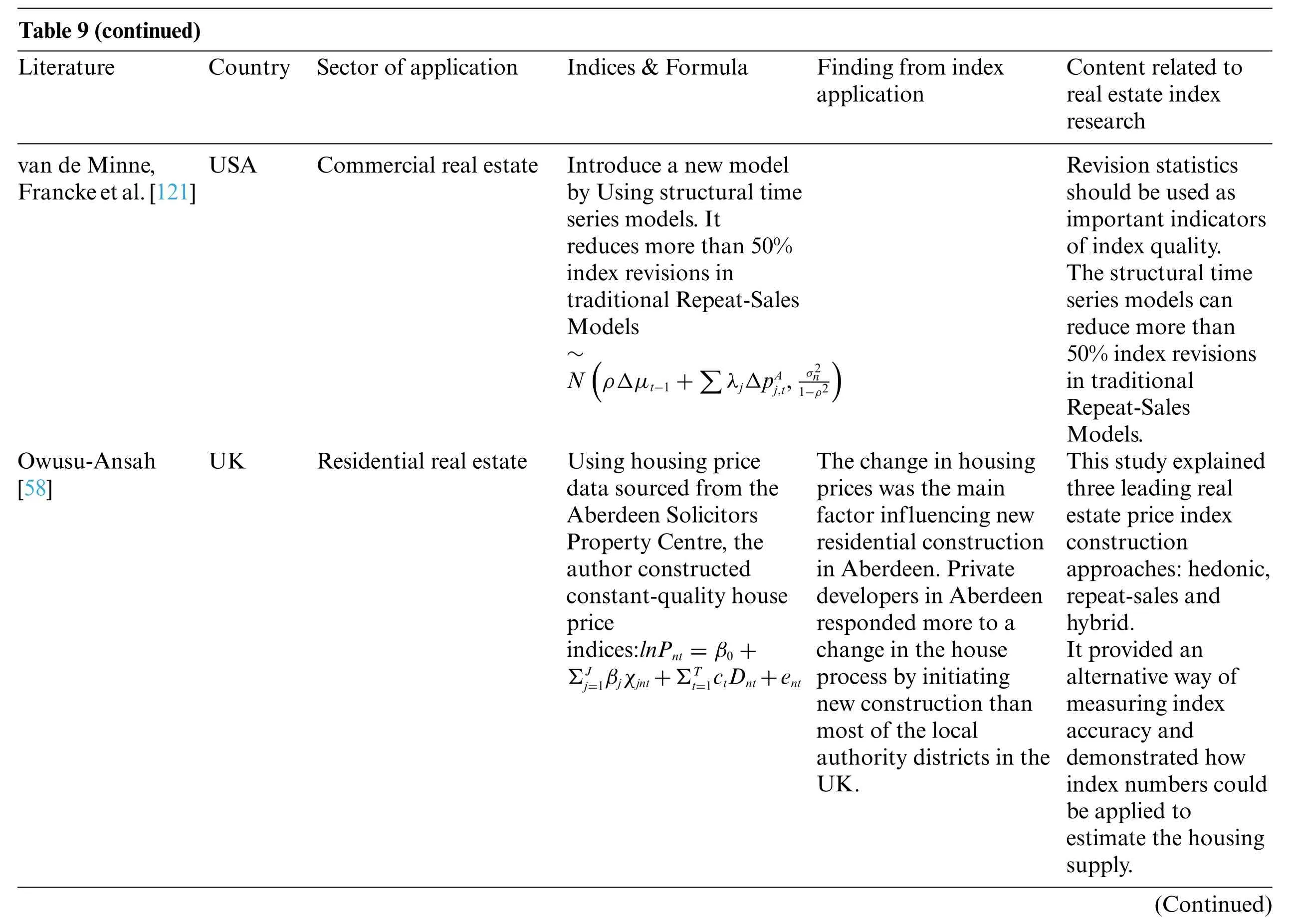

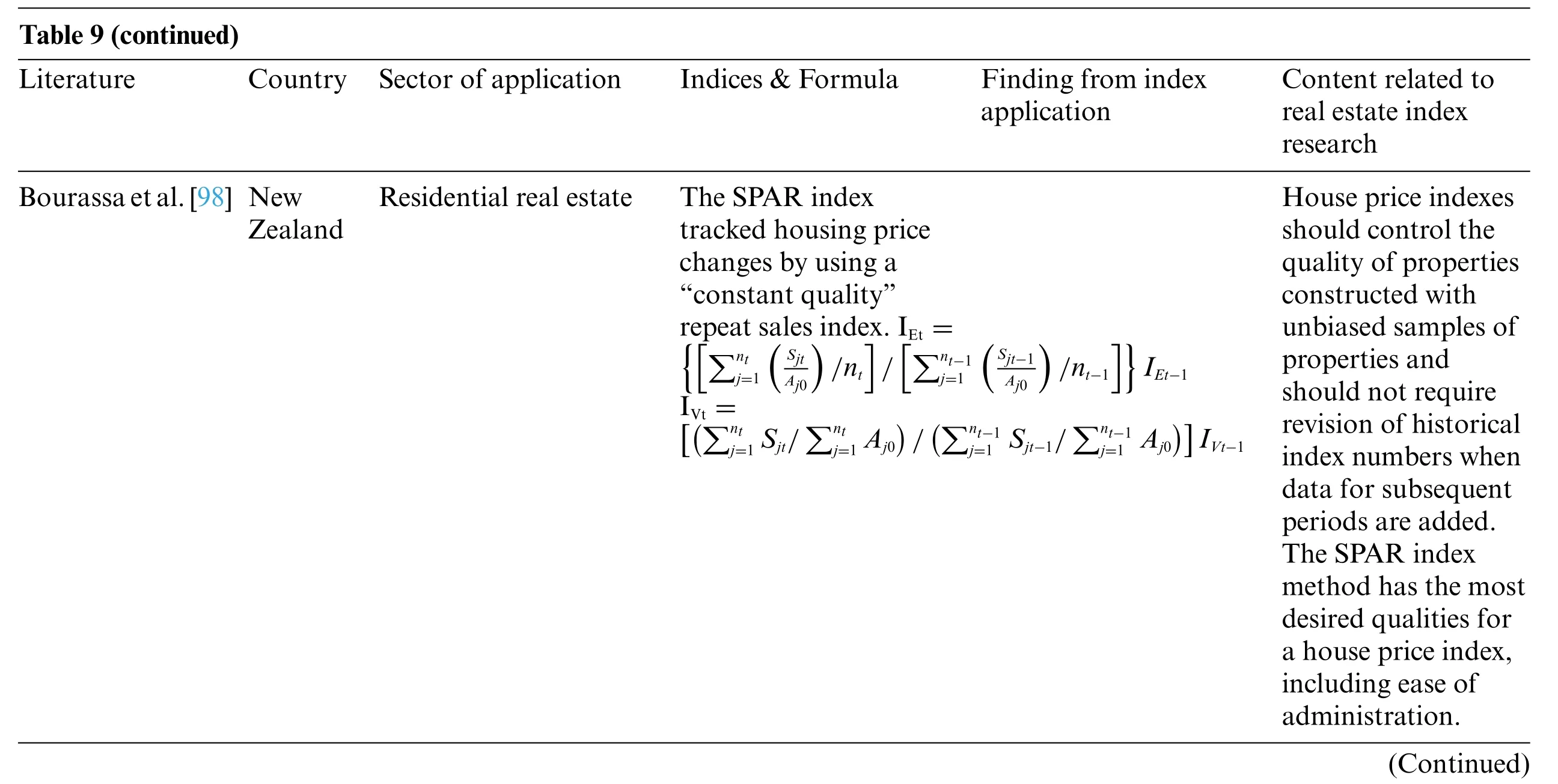

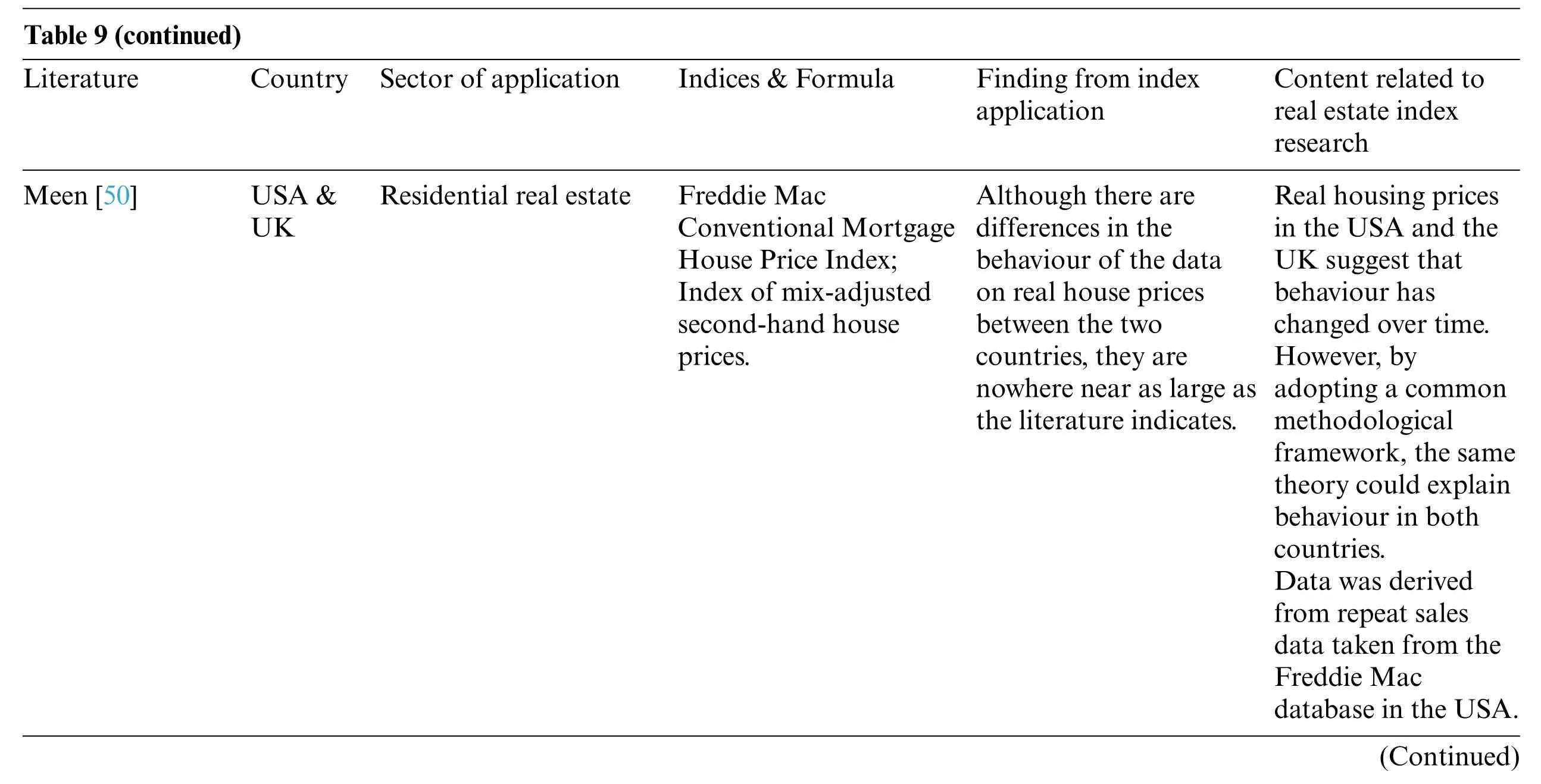

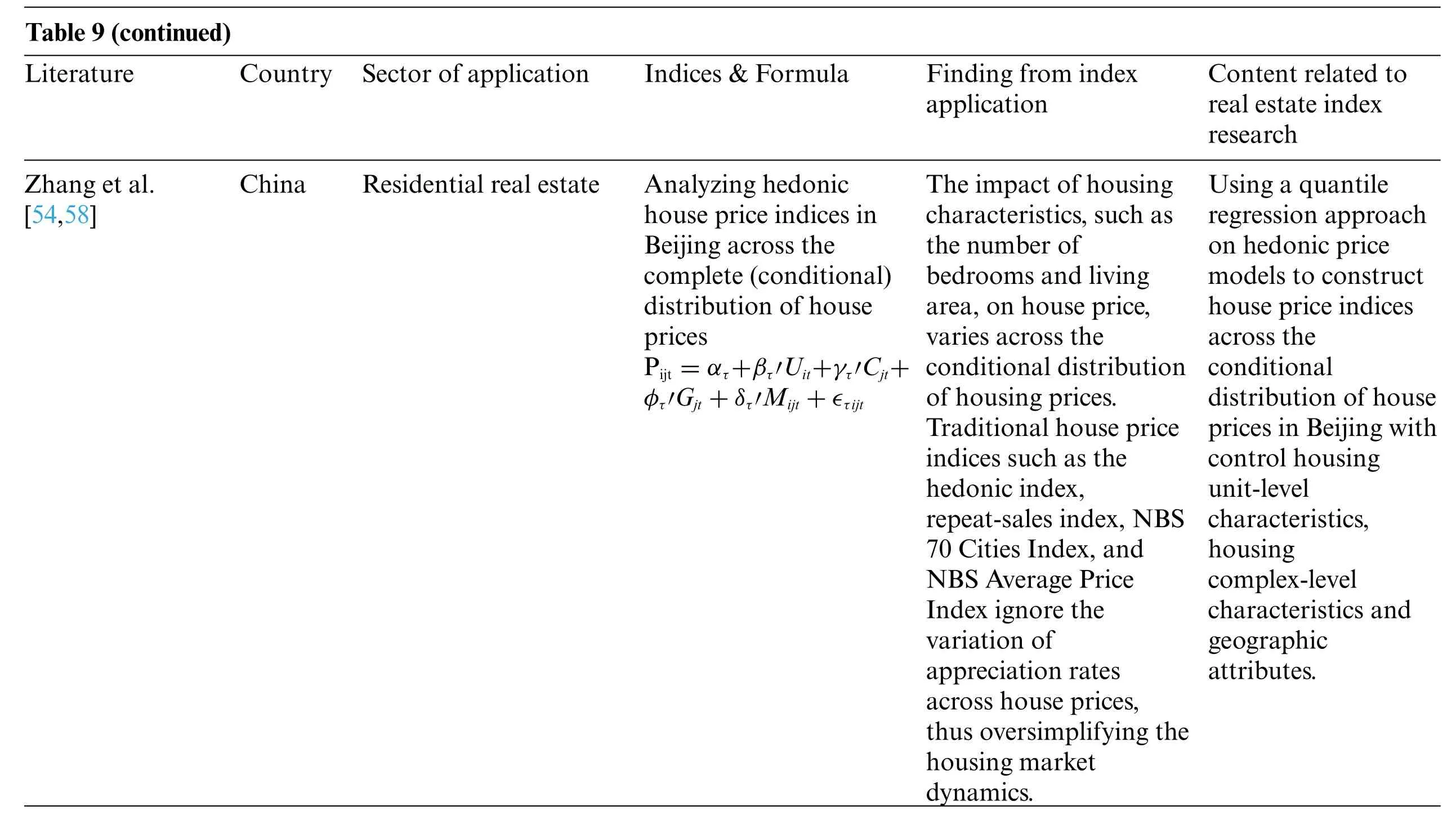

There is no consensus regarding which index construction method performs best regarding accuracy.However,over the past two decades,the innovation and honing of the real estate transaction price indexing method have been impressive.The index method has been greatly improved,but large-scale transaction databases have been developed[53](see Table 8).For example,van de Minne et al.[121]suggested a structural time series model which can reduce overall index revisions by more than 50%,and Zhang et al.[54]constructed the first quantile house price indices in China to provide insight into the evolution of China’s house price distribution.The feature of a suitable property price index method should include,but are not limited to the following[98]:1)require fewer data in implementation;2)use data which is representative of the inventory;3)standardize quality(constant-quality);4)easy to implement;5)no need to change the index construction method when historical numbers are revised.

Table 8:Indices construction approaches(an updated version of[58])

2.4 Carpark Index Construction

The 34,562 carpark transaction data from December 2009 to June 2019 obtained from CarparkHK.com [122] were included in this research.The website included information about the districts of the carparks,transaction price,date of the transaction and addresses of the carparks.

Firstly,the repeat sales index was used to analyze the carpark price of 18 districts in Hong Kong.Secondly,these data were used to collect the date and the price of the first and second sales for the carpark transaction.Thirdly,we calculated the log price of the difference for each carpark unit.Then,a dummy matrix was created,defining December 2009 as the base period,and the index of this year was equal to 1(The last year of the research was June 2019).Finally,the number was put at“–1”if the year of the first sale was equal to the current year,equal to“1”if the year of the second sale was equal to the current year;otherwise,the number of as put at 0.

The first step was to input the data of all 18 districts in Hong Kong(HK).After combining these data into Excel,Rstudio was used to obtain the repeat sales index.Secondly,a linear regression model was used to obtain the coefficient of the repeat sales index.The formula was as follows:

Index=lm (Logp ~0 + Y201001 + Y201002 + Y201003 + Y201004 +...+ Y201904 +Y201905+Y201906,data=Data).The exponents(unti-log the coefficient of the repeat sales index)were then calculated and a code of“plot(exp(coef(index)))”was used to obtain the plot of the repeat sales index.

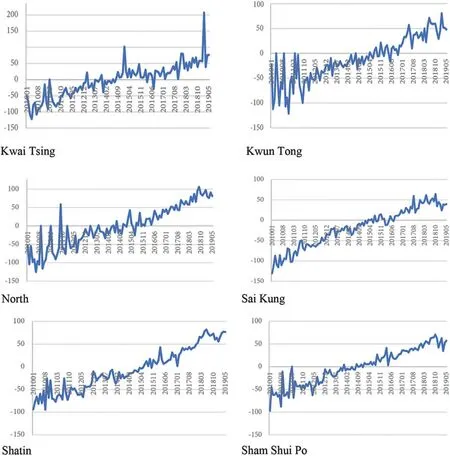

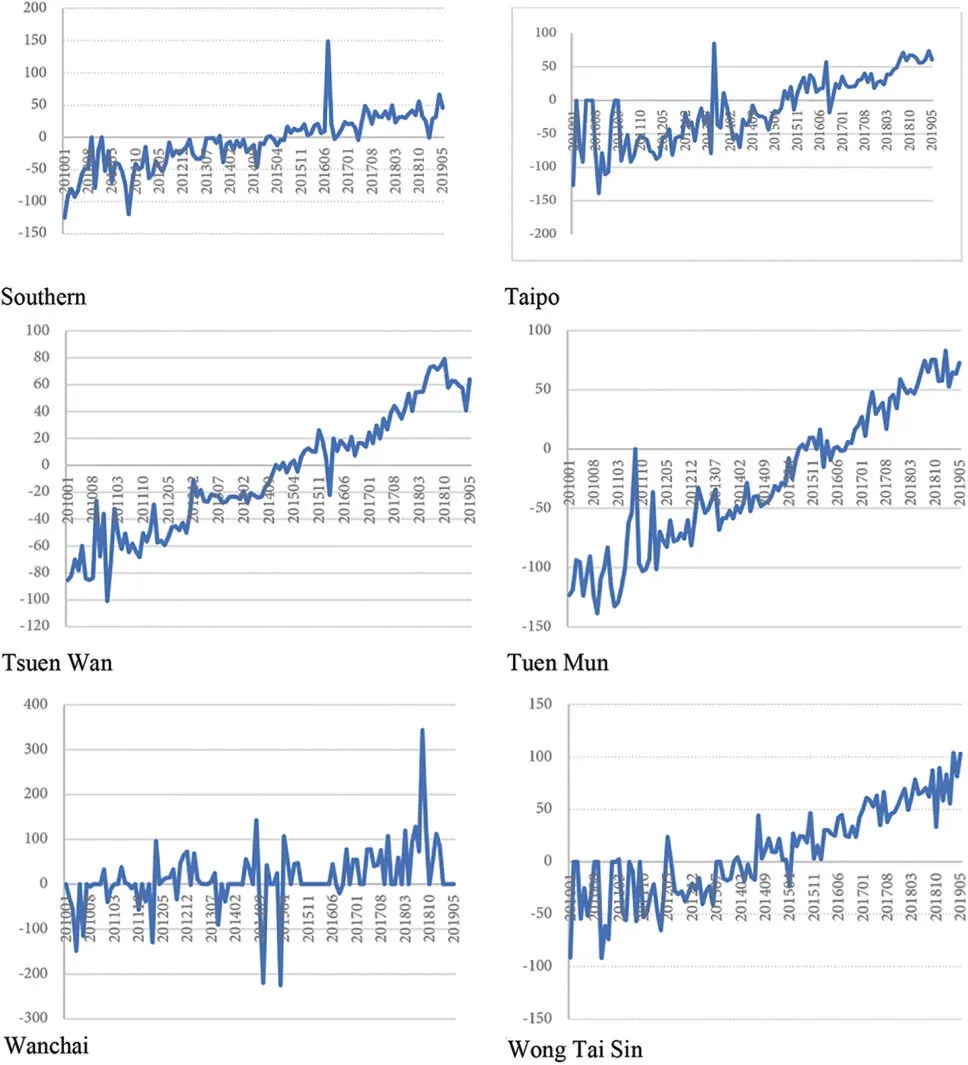

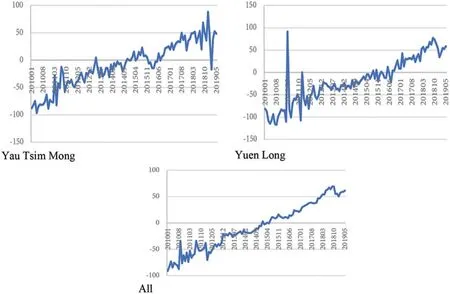

The results are shown in Fig.3 and the location of these 18 districts are depicted in Fig.4.While almost all of them oscillate around an increasing trend,the North district only displays a slight increase in price index compared to other districts.The Wanchai district’s carpark price index does not have a clear upward trend.

Figure 3:(Continued)

Figure 3:(Continued)

Figure 3:(Continued)

Figure 3:Repeat sales indices in 18 districts in Hong Kong and overall index for Hong Kong in general

Figure 4:18 administrative regions in Hong Kong

2.5 Automatic Machine Learning(AutoML)

Today,the popularity of Web 2.0,such as Facebook and Linkedin [123] has increased data size substantially;big data,artificial intelligence,data mining,machine learning,pattern recognition,computational intelligence and other theories and technologies are applied in many aspects,such as:

1.image processing and classification:upsampling[124],facial recognition[125],crack detection[126];

2.Natural language processing:sentiment classification[127–129],land use classification[130],tokenisation[131],chatbots[132,133];

3.Numerical data handling and analysis:scheduling[134,135]and planning[136],data analytics[137,138],forecasting[139],and inventory management[140].

Prediction using artificial intelligence is a key area in modern real estate research,apart from the traditional econometrics models like the Autoregressive Moving Average model (ARMA) [141,142]and the Autoregressive Integrated Moving Average model (ARIMA) for real estate time series prediction,Li et al.[143]utilized State Space models for forecasting real estate stock prices.Various types of AI and machine learning models have been used for real estate asset price predictions in recent years.For example,Li et al.[144]applied a long short term memory(LSTM)and an artificial neural network[145]for housing price prediction,and a Group Method of Data Handling Neural Network for forecasting real estate investment trusts and stock indices[75].

Most AI and machine learning approaches need fine-tuning.Automated machine learning(AutoML)is a promising solution for building a deep learning system in the absence of human effort and has been applied in many different fields [146],such as finance [147] and ICU (intensive care unit) triage prediction [148].The automated model selection method in AutoML includes feature engineering and neural architecture searching;AutoML streamlines the construction and application of machine learning models and significantly decreases the time,and improves the customized models’accuracy by reducing human errors [149].For example,Gerassis et al.[150] utilized AutoML to study the impacts of mining activity on deterioration in ecosystems,including the secondary industry pollution from natural slate manufacturing.Li et al.[151] utilized satellite data from 2014 to 2018 from the US Geological Survey as a proxy for the urban heat island effect.They then used that for conducting housing price prediction via AutoML.

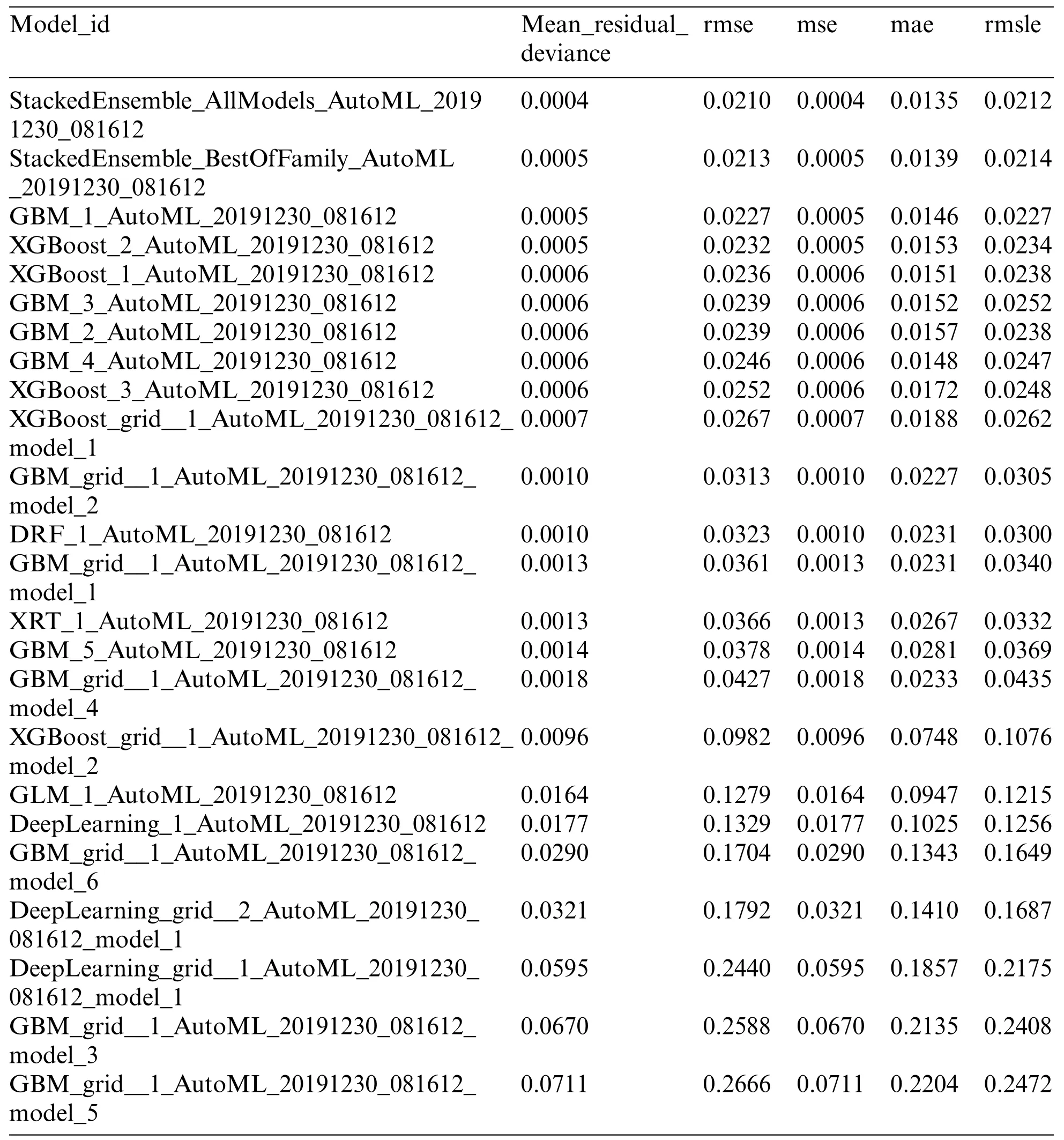

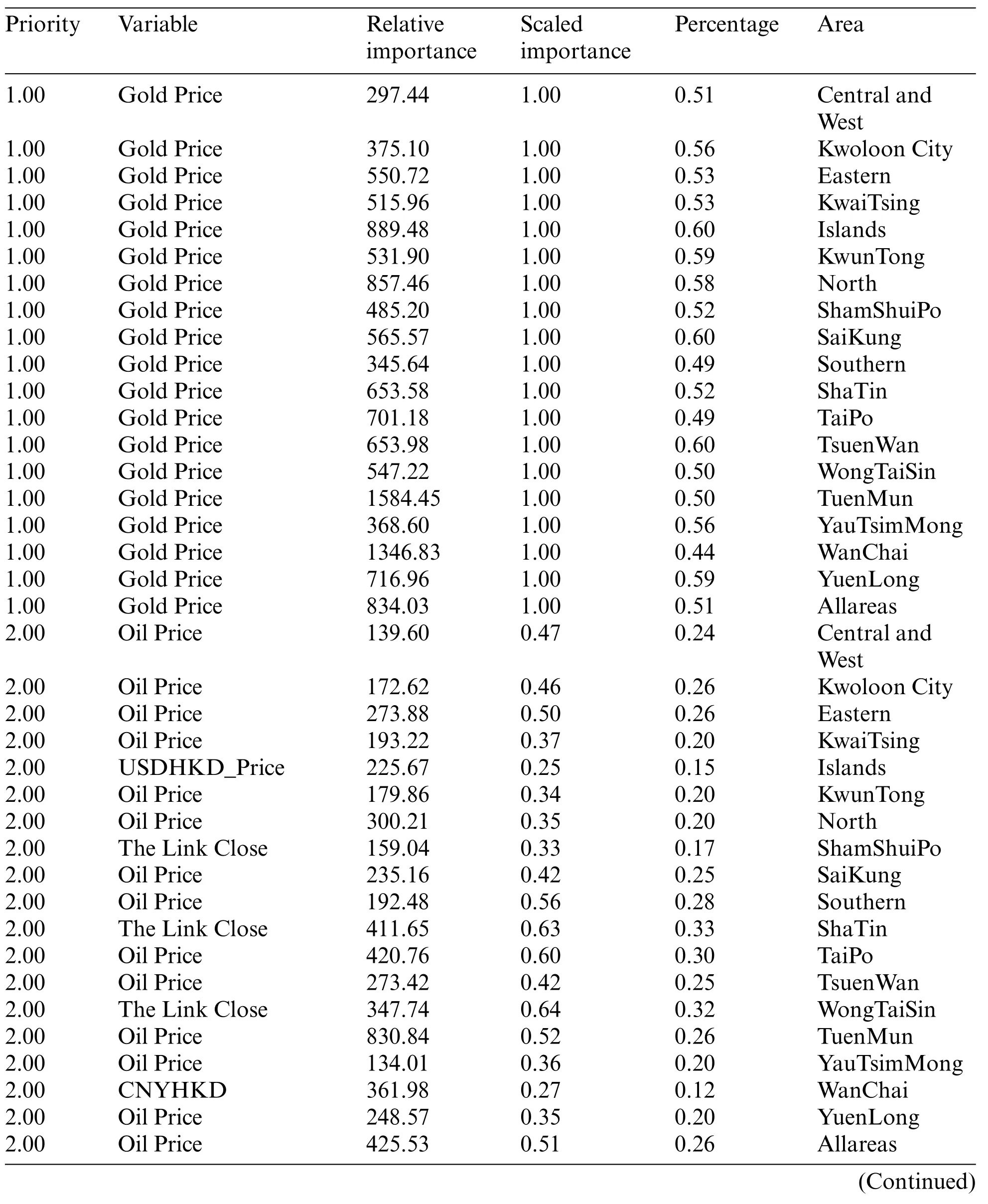

Our research used the Automatic Machine Learning(AutoML)model,utilizing automatic feature selection,feature transformation and automatic hyper-parameter tuning[152,153],model generation and model evaluation methods[146].AutoML eases the application of machine learning[153],as it automatically streamlines the whole machine learning process from data loading,modelling and model picking.It ran through over 30 models and automatically picked the best model based on the lowest error values:mean residual deviance,root mean square error(rmse),mean squared error(mse),mean absolute error(mae),root mean squared logarithmic error(rmsle)(Table 10).For the best model,it ranked different variables’relative importance as features based on a top-down approach(Table 11).

The same dataset was run with 18 districts(Fig.3)to discover the features that drove the carpark price indices up and down most (Table 9).We included several variables which might correlate with carpark price as per other types of property markets in Hong Kong,such as housing(direct real estate)and real estate stock prices(indirect real estate):gold and oil price,Renminbi to Hong Kong dollars,US dollar to Hong Kong dollar,and the Link’s price.Gold has been considered an investment tool when many assets are risky,and oil price is related to the costs of using an automobile.When the cost of oil is high,demand for cars decreases so does the price of the carparks.As many property investors come from China,the carpark market is no exception.We speculated that,similar to other types of property in Hong Kong[143],rises and falls in Renminbi affect our carpark prices.Lastly,The Link is one most significant scale real estate investment trusts in Hong Kong and may be an indicator of the real estate market in Hong Kong.

Table 9:Studies with real estate index content

This study explained Content related to real estate index research Revision statistics should be used as important indicators of index quality.The structural time series models can reduce more than 50%index revisions in traditional Repeat-Sales Models.Finding from index application)1-ρ2 Formula λjΔpA j,t,σ2n Commercial real estate Introduce a new model by Using structural time series models.It reduces more than 50%index revisions in traditional Repeat-Sales∑Indices&Models three leading real estate price index construction approaches:hedonic,repeat-sales and(Continued)hybrid.It provided an alternative way of measuring index accuracy and demonstrated how index numbers could be applied to estimate the housing supply.prices was the main factor influencing new residential construction in Aberdeen.Private developers in Aberdeen responded more to a change in the house process by initiating new construction than most of the local authority districts in the UK.The change in housing(ρΔμt-1+~N data sourced from the Using housing price Table 9(continued)Country Sector of application USA Aberdeen Solicitors Property Centre,the author constructed constant-quality house price j=1βjχjnt+ΣTt=1ctDnt+ent indices:lnPnt =β0+ ΣJ Residential real estate Literature van de Minne,Francke et al.[121]UK Owusu-Ansah[58]

Content related to real estate index research The hedonic method allows researchers to control for both the complex level quality changes and the effect of developers’pricing behaviours;hence in the newly built housing markets in China,it offers better measurement for housing price movement.(Continued)Finding from index application The new index revealed that the Chinese housing market faced a greater risk of mispricing than reported by the existing official metrics(“Average Price Index”&“70 Cities Index”).Formula Indices&This study applied a hedonic method to the 35 major newly-built housing markets and provided the first multi-city constant-quality house price index in China:Pijt =α·OUit+λ·UUit+β·OCjt+φ·UCjt+θ ·PBijt+δt·Dijt+μijt Country Sector of application Residential real estate Table 9(continued)China Literature Wu et al.[59]

Content related to real estate index research House price indexes should control the quality of properties constructed with unbiased samples of properties and should not require revision of historical index numbers when data for subsequent periods are added.The SPAR index method has the most desired qualities for a house price index,including ease of administration.(Continued)Finding from index■IEt-1images/BZ_781_2331_1265_2377_1311.pngimages/BZ_781_2350_1265_2395_1311.pngIVt-1 application)■/nt-1 j=1 Aj0(Sjt-1 Aj0 j=1 Sjt-1/∑nt-1 Formula∑nt-1/images/BZ_781_1927_1265_1973_1311.png∑nt-1 j=1 changes by using a The SPAR index tracked housing price“constant quality”repeat sales index.IEt = ■■∑nt j=1)■■/nt/Indices&(Sjt Aj0images/BZ_781_1871_1265_1917_1311.pngj=1 Sjt/∑ntj=1 Aj0 IVt =images/BZ_781_1511_1265_1557_1311.pngimages/BZ_781_1529_1265_1575_1311.png∑nt Country Sector of application Residential real estate Table 9(continued)Zealand Literature Bourassa et al.[98] New

Content related to real estate index research Real housing prices in the USA and the UK suggest that behaviour has changed over time.However,by adopting a common methodological framework,the same theory could explain behaviour in both countries.Data was derived from repeat sales data taken from the Freddie Mac database in the USA.(Continued)Finding from index application Although there are differences in the behaviour of the data on real house prices between the two countries,they are nowhere near as large as the literature indicates.Formula ac Indices&Freddie M Conventional Mortgage House Price Index;Index of mix-adjusted second-hand house prices.Country Sector of application Residential real estate Table 9(continued)USA&UK Literature Meen[50]

Content related to real estate index research It examined how price risk affected housing demand in two channels:a financial risk effect reduced demand and a hedging effect increased demand.Current homes might hedge future housing costs by constructing a hedonic-adjusted house price index from the OFHEO repeat sales price.(Continued)Finding from index application In response to financial incentives,households reduce current housing demand to avoid future financial risk.In response to hedging incentives,households take a more prominent position to offset potentially high housing costs in the future.Formula ac Indices&Freddie M Conventional Mortgage House Price Index;The hedonic-adjusted house price index.Residential real estate Table 9(continued)Country Sector of application USA Literature Han[52]

Content related to real estate index research Using a quantile regression approach on hedonic price models to construct house price indices across the conditional distribution of house prices in Beijing with control housing unit-level characteristics,housing complex-level characteristics and geographic attributes.Finding from index application The impact of housing characteristics,such as the number of bedrooms and living area,on house price,varies across the conditional distribution of housing prices.Traditional house price indices such as the hedonic index,repeat-sales index,NBS 70 Cities Index,and NBS Average Price Index ignore the variation of appreciation rates across house prices,thus oversimplifying the housing market dynamics.Formula Indices&Analyzing hedonic house price indices in Beijing across the complete(conditional)distribution of house prices Pijt =ατ+βτ′Uit+γτ′Cjt+ φτ′Gjt+δτ′Mijt+∈τijt Table 9(continued)Country Sector of application Residential real estate China Literature Zhang et al.[54,58]

Table 10:Errors of all the models in AutoML

Table 11:Model features

Table 11 (continued)Priority Variable Relative importance Scaled importance Percentage Area 3.00 Car Park Affordable Ratio 45.04 0.15 0.08 Central and West 3.00 Car Park Affordable Ratio 52.19 0.14 0.08 Kwoloon City 3.00 The Link Close 94.72 0.17 0.09 Eastern 3.00 USDHKD_Price 69.36 0.13 0.07 KwaiTsing 3.00 Oil Price 158.32 0.18 0.11 Islands 3.00 The Link Close 73.41 0.14 0.08 KwunTong 3.00 The Link Close 123.00 0.14 0.08 North 3.00 Oil Price 157.64 0.32 0.17 ShamShuiPo 3.00 The Link Close 44.54 0.08 0.05 SaiKung 3.00 Car Park Affordable Ratio 42.59 0.12 0.06 Southern 3.00 Oil Price 67.20 0.10 0.05 ShaTin 3.00 Car Park Affordable Ratio 121.94 0.17 0.09 TaiPo 3.00 The Link Close 55.81 0.09 0.05 TsuenWan 3.00 Car Park Affordable Ratio 105.43 0.19 0.10 WongTaiSin 3.00 The Link Close 243.21 0.15 0.08 TuenMun 3.00 The Link Close 59.68 0.16 0.09 YauTsimMong 3.00 USDHKD_Price 340.21 0.25 0.11 WanChai 3.00 The Link Close 105.86 0.15 0.09 YuenLong 3.00 The Link Close 171.36 0.21 0.10 Allareas

The Gold Price ranked first in all 19 models;oil price was the second most important variable in 14 models.Interestingly,there are three districts(Shum Shui Po,Wong Tai Sin,Shatin)where the second important variable was the Link stock price.The Link has many carparks among the company’s assets,especially in the three districts mentioned.There were five districts(Central and West,Kowloon City,Southern,Taipo,Wong Tai Sin)in the carpark affordability ratio for the third important variable.

3 Conclusion

There has been researched on carparks’impact on housing prices in the past.For example,a one-unit increase in carparks caused housing prices to drop from$95,928 to$59,569,and ppsf(price per square foot) decreased by $1.389658 [154].However,no research has constructed the carpark price index via repeated sales methods,not to mention predicting the carpark price index via an AutoML approach.According to our big data and natural language processing results of articles published between 1910 to 2019,indexed in Google,most threw light on multi-storey carparks,management and ventilation systems,and reinforced concrete carparks.This study indicated that the second transactions of Wanchai’s carpark price was about four times that of Yuen Long’s carpark price.

Our novel research suggests new ways for determining car park indices in urban areas.It is the first to construct carpark indices based on carparks with repeated sales from 1910 to 2019.It then used real estate indices and AutoML,a type of artificial intelligence method to predict carpark indices in the 18 regions of Hong Kong.This research showed the features that affected the carpark price AutoML prediction model most:gold price ranked the first in all 19 models;oil price or Link stock price second depending on district,and carpark affordability ratio third.

The results provide practical implications to allow us to know more about the price gap in carpark markets in Hong Kong.As most types of properties,that is,residential,offices,industrial buildings etc.have already constructed their indices by the Rating and Valuation Departments,with carparks as an exception.Our research will be helpful to the government when they formulate the carpark price indices and inform governments in other countries.It also fills the academic void of carpark price prediction via AutoML and contributes to academia.

Funding Statement:The authors received no specific funding for this study.

Conflicts of Interest:The authors declare that they have no conflicts of interest to report regarding the present study.

Computer Modeling In Engineering&Sciences2023年3期

Computer Modeling In Engineering&Sciences2023年3期

- Computer Modeling In Engineering&Sciences的其它文章

- A Consistent Time Level Implementation Preserving Second-Order Time Accuracy via a Framework of Unified Time Integrators in the Discrete Element Approach

- A Thorough Investigation on Image Forgery Detection

- Application of Automated Guided Vehicles in Smart Automated Warehouse Systems:A Survey

- Intelligent Identification over Power Big Data:Opportunities,Solutions,and Challenges

- Broad Learning System for Tackling Emerging Challenges in Face Recognition

- Overview of 3D Human Pose Estimation